Smartphone have changed many aspects of our lives, from the way we communicate to the way we shop. However, one thing has till now eluded their powers of evolution, the adoption of mobile wallet. As a recent report by Blackhawk Network reveals, users in the US may be shopping a whole lot via their smartphones, but they prefer the traditional methods of cash and plastic over mobile wallets or cryptocurrency. This remains unsurprising considering the fact that people have traditionally taken a long time to embrace new forms of payment as there is an inherent learning curve involved. The skepticism has been also fueled by a spate of bugs and vulnerabilities that have been discovered in the past year on both iOS as well as Android.

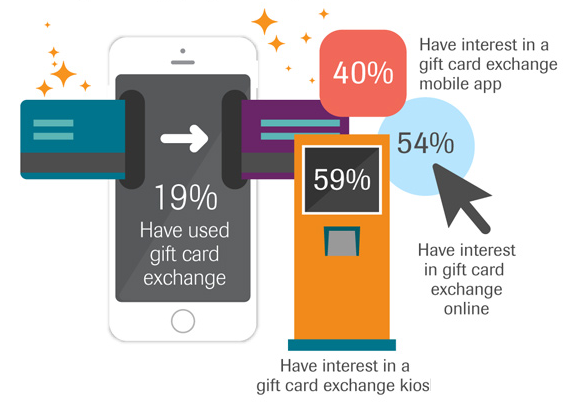

However, despite cash, cheque, credit and debit cards hogging up the top spots, gift cards have made a strong appearance with nearly 4 out of 10 people warming up to the concept. It’s not all bad news for Mobile wallets though as 1 out of every 3 smartphone user has used some sort of mobile wallet in the past year. Customer demand has also played a big part in developing newer technology as we see gift card exchange, a tool designed specifically to satiate consumer requests has seen usage by over 19% of US shoppers. We are standing at the cusp of a digital revolution in banking and today’s analysis of the US shopping scenario, provides us a glimpse into the wider mature smartphone markets around the world. To know what the future holds for cashless payments, join us as we dive into the numbers!

Traditional Methods of Payment Stay Tall As Newer Methods Struggle For Market Penetration

Unsurprisingly, 87% of the population still prefer to pay for their goods via cash and a good chunk at 60% prefer to pay for their products by cheques. However, the numbers are decreasing, and we find a YoY dip of 6% and 8% points in both the traditional forms of payments. One of the main reasons could be due to the decreasing use of cash for high-value purchases as cash is being primarily used by consumers for buying articles costing $20 or less. The usage of cheques have also declined and are now being used mainly for paying bills and other individuals at 23% and 18% respectively.

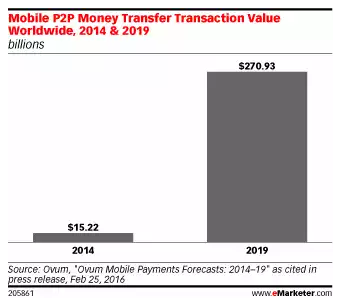

Turning our attention to the other two contenders in the list, we see that people are still attached to their tangible plastic cards as we see over 3 out of 4 people opting for debit cards while around 2 out of ever 3 people opt to use credit cards for their purchases as well. The younger generation, more specifically the millennials are responsible for using newer services like Mobile Wallets and P2P payments as they are the driving force behind the adoption of new technology.

While all of this was in line with our expectations, something that surprised us was the huge popularity of gift cards both as physical cards and their implementations in the form of e-gifts! 44% of the population are looking to buy gift cards this year, and what’s more, 19% have already used a gift card exchange program. The future looks rosy for gift cards as customers seem to be preferring them as the best way for rewards with 45% of the population chose gift cards over second placed PayPal that has garnered 38% of the choice.

Not only that, 69% of consumers are now familiar with eCodes and eGifts and more than half the consumers who have used eGifts and eCoupons are ready to use them yet again for this year.

With the adoption of plastic cards as well as digital gifts increasing at a rapid pace, the process of enticing consumers back for repeat business through rewards has become a viable strategy for most retail shops. But in a world where everyone is vying for consumer retention, just rewards aren’t enough to reduce customer churn. In our final segment, we look at a few more strategies that retail industries can look to invest in for the future.

Final Thoughts

Making shopping a rewarding experience by providing coupons and gift cards has been an age-old ploy. However, with more and more players looking to employ the same strategy, the effectiveness of rewards have started to wane. This is why we have highlighted few more points that retailers should be looking to implement to increase their sales:

- Provide Unique Consumer Experiences: Consumers are swayed by the service and quality of the experience they receive while shopping for any particular item, be it online or at a physical store. For physical stores, retailers can use a different variation of the gift card strategy to increase the footfall inside their shop. 74% of the people hope to receive a gift card this year and brands with offline stores can use this to their advantage. As for online, we have discussed before how innovative strategies like introducing a social aspect to the shopping experience can increase the interaction time within an app. Studies have shown that 78% of online shoppers use their experience as a metric for if they would return to the site again.

- Make it Convenient: Convenience has played a big part in the fact that smartphones have taken over a significant part of the internet shopping experience in the Asia Pacific. And one of the major factors involving convenience is the choice for consumers to pay as they wish. With the advent of contactless payments such as Apple Pay and Samsung Pay, retail shops need to update their payment portals to support mobile wallets as well as NFC-based payments in physical locations.

Smartphones are gradually making their way into our financial lives, but the pace of their adoption remains amidst heavy doldrums as Mobile OSs’ struggle with security vulnerabilities and public awareness and trust remains hard to come by.