Who would’ve imagined sending money to your friends and family would one day become as effortless as sending a text via your favourite instant messaging app?

Over the past five years, the digital payments landscape in India has undergone a rapid transformation, with several tech giants now entering the fray. Meta Platforms, Inc. (NASDAQ: META) ventured into this arena by introducing its payment service on WhatsApp in late 2020, letting Indian users send money to anyone using a UPI-supported app.

Nearly three years later – after failing to capture a sizeable share of the UPI payment market – the social media behemoth is poised to redefine the essence of digital payments by expanding its payment options on WhatsApp within India. This ambitious move is driven by a strategic vision to enhance its commerce capabilities, particularly in its largest user base region, APAC.

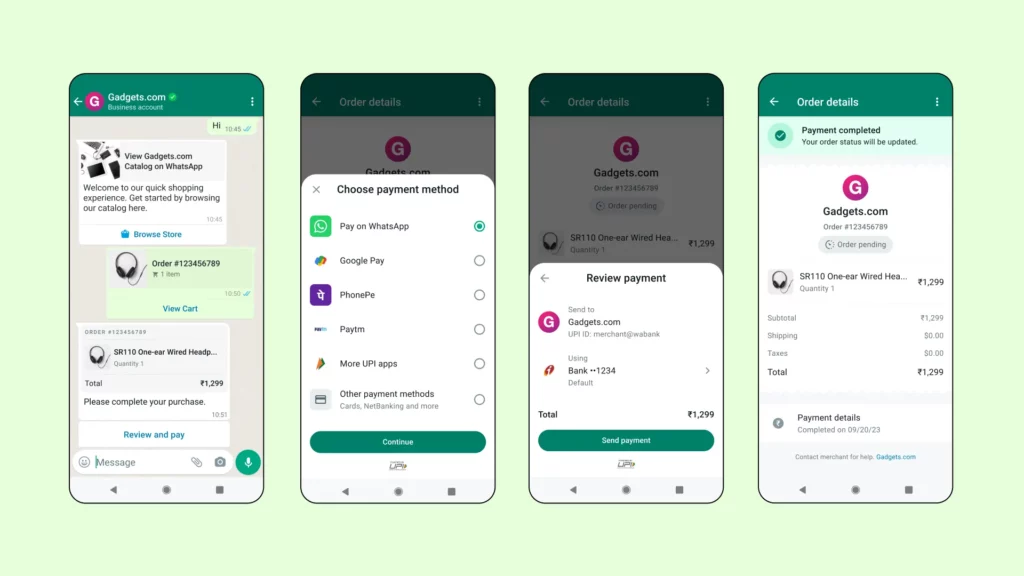

Operating under the expansive Meta umbrella, WhatsApp has entered strategic partnerships with payment industry titans PayU and homegrown Razorpay. Together, they offer businesses a diverse array of payment options right from within the WhatsApp platform, including credit and debit cards, net banking, and compatibility with all UPI apps widely used in India.

In simpler terms, WhatsApp users in India will soon be able to make seamless payments to businesses by selecting any payment method without ever leaving the messaging app.

WhatsApp’s decision to integrate UPI apps and other payment methods in India comes on the heels of its fruitful partnership with Stripe in Singapore earlier this year. It allows Whatsapp users in Singapore to make in-app payments to businesses conveniently. To demonstrate its financial muscles, Meta also introduced merchant payments within the WhatsApp app in Brazil just a few months ago.

“This is going to make it even easier for people to pay Indian businesses within a WhatsApp chat using whatever method they prefer,” said Meta CEO Mark Zuckerberg.

WhatsApp has confirmed that the new payment feature is available on its business platform.

A closer look, however, depicts a different picture about the journey and success of WhatsApp in India’s Payment arena. Let us take a deep dive to understand the adoption of the newly launched WhatsApp payment feature for businesses in India and explore the reasons behind the lukewarm response received despite having more than 500 million users in the country.

WhatsApp Pay Struggles to Gain Traction In India

WhatsApp rolled out its payment feature in India in November 2020, leveraging the Unified Payments Interface (UPI) framework. The timing was intriguing, with WhatsApp boasting a whopping 400 million users on its messaging platform nationwide.

However, the excitement was tempered by a regulatory cap imposed by the National Payments Corporation of India (NPCI), initially allowing just 20 million users to tap into this new feature. As the months rolled by, the cap was gradually raised to 40 million users, but WhatsApp hungered for more. It took nearly two years of perseverance and determination, but finally, the NPCI granted approval to WhatsApp Pay to expand its user count to 100 million, a milestone that was finally achieved by the end of April 2022.

In an effort to entice more Indians to use WhatsApp’s in-app payment feature, Meta partnered with Reliance Industries in August 2022. This collaboration aims to provide a comprehensive shopping experience through its JioMart bot within the messaging platform.

The recent inclusion of third-party payment options for merchants on the WhatsApp Business platform signifies a significant step forward. This strategic move not only enhances convenience for both customers and businesses but also extends the scope of WhatsApp as a robust commerce solution.

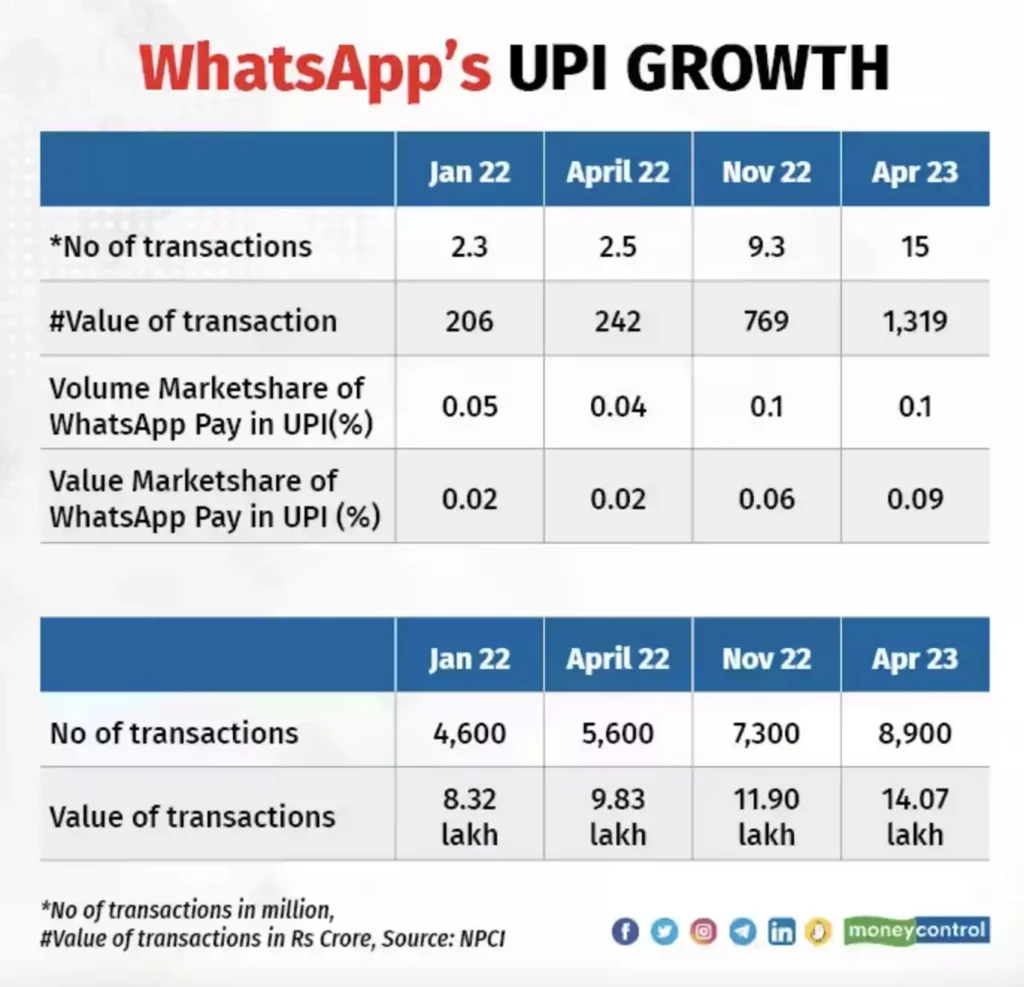

It’s worth noting that despite WhatsApp’s colossal user base of over 500 million, a mere fraction, approximately 15 million users in India, have adopted its business app. The platform has yet to witness a significant number of its regular users making purchases through its platform. Although WhatsApp has witnessed remarkable growth within the UPI market, in terms of both volume and value of transactions, it still holds less than a 1% market share in both of these critical metrics. This presents a unique challenge and opportunity for Meta as it navigates the dynamic landscape of digital payments in India.

To put it in perspective, in January 2022, WhatsApp’s UPI payments processed 2.3 million transactions worth Rs 206 crore in India. By November 2022, the number of transactions volume increased a whopping 304% to 9.3 million. Simultaneously, the total value of these transactions conducted through the WhatsApp UPI feature in India increased 273% to Rs 769 crore.

WhatsApp market share in India’s UPI space doubled from 0.05% to 0.1% in terms of transaction volume and tripled from 0.02% to 0.06% in terms of transaction value between January and November 2022. However, this surge was partly driven by a week-long campaign in March 2022, where WhatsApp processed an astounding 8-10 million transactions daily and onboarded over 1.6 million users each day, all without spending a dime on marketing. The initial response to this campaign among Indian WhatsApp users was nothing short of phenomenal. However, as events unfolded, it became apparent that these early successes were not indicative of sustained dominance.

In April 2023, WhatsApp’s UPI payments impressively handled 15 million transactions with an impressive YoY growth of 500%. Notably, the value of these transactions also surged an astonishing 445% YoY during the same period, amounting to Rs 1,300 crore.

Surprisingly, despite the impressive growths in transaction volume and value, WhatsApp’s share in the UPI market in India remains relatively modest, standing at just 0.17% in terms of transaction volume and 0.09% in terms of transaction value as of April 2023. As per the latst data released by NPCI, WhatsApp is 11th most popular app, accounting for just 0.18% share of the total UPI Transaction Volume in July 2023. However, it’s noteworthy that this market share has dramatically increased from just 0.04% in terms of transaction volume and 0.02% in terms of transaction value compared to the year-ago period. This notable growth underscores WhatsApp’s growing influence within the Indian digital payments landscape and its potential for further expansion.

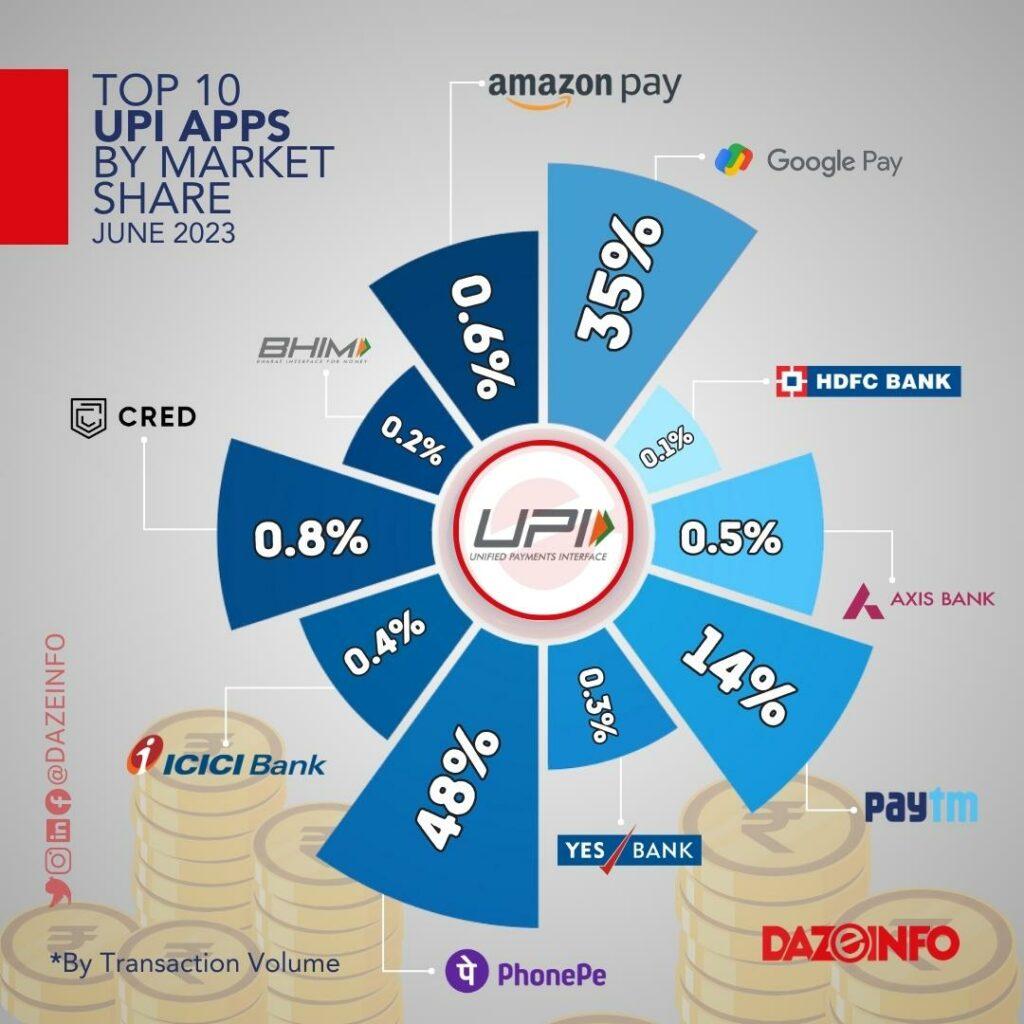

The strategic diversification of payment choices on the WhatsApp platform for Indian users could potentially be a game-changer for Meta as it strives to establish a strong presence in India’s digital payment market. This market is dominated by well-established players such as Walmart-owned PhonePe, Google Pay, and the Indian fintech behemoth Paytm.

In comparison, PhonePe maintained a dominant position with a 47.39% share in transaction volume and an impressive 50.47% market share in transaction value in April 2023.

As per NPCI’s data, PhonePe, Google Pay, and Paytm collectively facilitated a staggering 9631.91 million UPI transactions, amounting to Rs 14.50 lakh crore in July 2023. This commanding performance translates into an overwhelming 97% market share in terms of transaction volume and 95% market share in terms of transaction value during the same period.

WhatsApp Pay: Cracking the Code

Contrary to initial fears of WhatsApp quickly dominating the Indian UPI market due to its massive user base, the reality turned out quite different. In fact, these concerns were a significant factor that led the National Payments Corporation of India (NPCI) to introduce a 30% volume cap for third-party UPI app providers (TPAPs). This move aimed to ensure a more balanced and competitive landscape within the UPI ecosystem.

Given that two UPI apps, PhonePe and GooglePay, had collectively captured 80% of the UPI market share at that time, NPCI had high hopes that WhatsApp could easily challenge the dominance of these existing players. Many stakeholders in the ecosystem were eager to see WhatsApp succeed. However, by the end of 2022, the top leadership at NPCI had grown disillusioned, realizing that WhatsApp’s ascension to a prominent position in India’s UPI market was unlikely to happen in the near future.

Let’s explore the primary two factors contributing to WhatsApp’s inability to secure a substantial foothold in India’s UPI market.

Trust Issues

Social media platforms like Facebook and WhatsApp are the life of the party. They keep us entertained, help us connect with friends and family, and serve as our virtual playground. Yet, they often take a backseat when it comes to matters of finance and sensitive data. The fear of potential data breaches and hacking incidents has left many hesitant to entrust them with their financial dealings.

In contrast, UPI apps like Google Pay and PhonePe have earned a reputation for reliability and security, making them the go-to choices for users when transferring money to friends, family, or businesses.

Moreover, even those who opt for WhatsApp payments for shopping or transferring funds to others often adopt a cautious approach. They typically engage in smaller transaction amounts and refrain from venturing into larger transactions exceeding Rs 10,000. In a world where every rupee counts, these preferences speak volumes about the importance of security and reliability in digital payments.

No Cashback and Offers

WhatsApp faced a significant challenge in the Indian market due to its reluctance to leverage cashback incentives, a proven effective strategy for numerous local competitors. India is renowned for its price-sensitive market, where discounts and cashback offers play a pivotal role in incentivizing consumers to purchase through specific apps or use particular credit/debit cards. Even in a fiercely competitive landscape, prominent companies like Uber and Amazon have faced robust local competition, but their judicious use of discount and cashback offers helped them attract a larger customer base. Google Pay, PhonePe, Paytm, and Amazon Pay UPI, have all solidified their presence by consistently providing cashbacks to users.

“India is not a free market. To change existing payment behaviour, you need to invest in payment discoverability within the app, make people aware that WhatsApp now offers payments, and incentivize them with cashbacks. WhatsApp was ambivalent or unhelpful on all of these fronts, which ultimately led to their failure in India,” said a senior fintech executive.

Sources familiar with the matter revealed to MoneyControl that the WhatsApp India team had requested a marketing budget of $50 million from Meta’s headquarters. This budget includes the funds for cashback incentives and promotional activities. Although Meta did allocate $50 million for the India team in 2021, they directed the marketing expenditure towards other priorities instead of focusing on payments. This decision disappiinted the entire Meta India team, as they had high expectations for the potential of payments in India.

In retrospect, it’s beacme clear that WhatsApp’s late entry into the UPI market led them to face stiff competition from already established players such as PhonePe, Paytm, GooglePay, and Mobikwik. An aggressive marketing approach and cashback offerings were essential to challenge the entrenched existing players.

The top executives at Meta seemed overly confident that WhatApp’s 500 million daily users in India would naturally transition to using the platform for payments, following a model similar to WeChat’s success in China. However, the Indian scenario underscored a crucial divergence between mere chatting and conducting financial transactions, highlighting the need for tailored strategies to succeed in this dynamic market, as noted by a fintech consultant having expertise in banking and startups.

Insufficient Authority to Make Decisions

Matthew Idema, the former Chief Operating Officer at WhatsApp, Inc., played a pivotal role in expediting the development of crucial payment features for the app in India. Under Idema’s leadership, the WhatsApp India team, including Ajit Mohan (former VP & MD at Meta India), Abhijit Bose (former WhatsApp Head of India), and Manesh Mahatme (former Director & Head of WhatsApp Pay, India), was granted autonomy to manage operations in the country, resulting in a brief period of success in 2020 and 2021.

However, a significant change occurred in late 2021 when Idema was transferred to the VP of the Business Messaging division of Meta, which once again limited the autonomy of the India team. During Matthew’s tenure, the India team had the authority to represent the company in negotiations with NPCI and banks. However, after his reassignment, every decision related to local operations required approval from headquarters.

In contrast, companies like PhonePe, a Walmart subsidiary, and Google’s India team took extensive measures to ensure their respective India payments divisions had the necessary resources for success.

Walmart permitted its subsidiary, PhonePe, to raise over a billion dollars, demonstrating strong support. Similarly, under the leadership of Caesar Sengupta, Google made significant investments in Google Pay (formerly Tez) as part of the Next Billion initiative. Alphabet CEO Sundar Pichai also appreciated the UPI technology and has urged the Federal Reserve to implement a similar instant payment system in the United States.

In a Nutshell

According to a senior fintech executive with ties to WhatsApp, the company still has the potential to gain a significant market share in India if it initiates a consistent marketing campaign and pairs it with cashback offerings. The executive points out that the app’s unique advantage lies in the fact that the average user spends 45 minutes on the platform and sends 50 messages per day – a level of engagement that no other payment app can easily match.

Despite the partnership with Jio and other opportunities, the path to success in India’s digital payments landscape may not be swift for WhatsApp. In the last three years, Meta India has witnessed the departure of several senior executives; therefore, the challenges in the market continue to exist.

The competitive nature of India’s digital payments market demands significant investments in time, money, and resources, which WhatsApp initially underestimated. Additionally, bureaucratic hurdles may have contributed to the challenges faced by WhatsApp in its quest to establish itself in the Indian payments sector.

Earlier this year, the Meta-owned messaging app introduced paid features for automation and custom merchant messages. However, the real game-changer is the recent expansion of its payment support, including integration with UPI apps, debit and credit cards, and more.

This strategic move is not just about user convenience; it can potentially boost revenue for WhatsApp. As the platform becomes a go-to destination for users seeking shopping and payment solutions, it naturally draws in a greater number of businesses. The result is a thriving ecosystem where users and businesses engage and transact seamlessly, creating a win-win situation for all parties involved.

In addition to expanding its payment options for Indians, WhatsApp is also enriching the in-app shopping experience with its innovative “Flows” feature. This functionality will empower users to perform various tasks directly from the messaging app, such as selecting a seat for a flight and booking an appointment. This multifaceted approach positions WhatsApp as more than just a messaging app; it transforms it into a versatile platform capable of catering to a broad spectrum of user needs, further solidifying its position in the ever-evolving digital marketplace.

What are your thoughts on WhatsApp’s payment features, which enable Indians to conduct their shopping and other digital activities seamlessly within the chat app? Are there any specific digital payment apps that you prefer to use? Let us know in the comment section below.