In the global smartphone market, where all major OEMs have been grappling with sluggish shipment growth over the last few quarters, Apple Inc. (NASDAQ: AAPL) is now wrestling with a much bigger problem, and it is none other than from one of its key iPhone markets – China. Recently, the Chinese government agencies have dropped a bombshell, effectively prohibiting their staff from using iPhones and other foreign-branded devices at work.

Reports from the Wall Street Journal reveal that employees at select central government regulatory bodies have received strict instructions – conveyed through hush-hush chat groups and covert meetings – to leave their fancy foreign gadgets at home. In addition to these measures, China has extended the iPhone ban to more government-backed agencies and state-owned enterprises.

The news triggered a 6% dip in Apple’s share price, from $189.70 on 5th September to $177.56 on 7th September. This is the worst two-day drop since November 2022. Prior to this setback, Apple had seen an impressive 46% increase in its stock price for the year, mirroring the overall upward trend in the technology sector.

For Apple, losing its grip on China could mark an unparalleled setback. It’s akin to a tech titan losing a crown jewel. This could potentially impact not only iPhone shipments but also the treasure chest of revenue that the Cupertino giant has been amassing from the Chinese market. Although Apple maintains a robust presence in the United States, India, and numerous European nations, the stakes in China are of a different magnitude.

The development leads us to a few pertinent questions, the answers to which could potentially reshape the market dynamics for the world’s most valuable tech company:

- Is China’s decision just the tip of the iceberg that the smooth sailing ship of Apple may hit soon?

- What would be the magnitude of this impact if China indeed enforces a complete ban on iPhones within its borders?

- Does the decision stem from a commitment to rejuvenate a specific smartphone brand on a global scale?

It is indeed a matter which deserves a closer look!

The current state of affairs is a product of the longstanding US-China cold war. To gain a comprehensive understanding of the situation today, let’s delve into the historical context first!

US-China Tech Clash

For an extended period, the USA and China have been embroiled in a trade conflict, with technology firms squarely in the spotlight.

The technological tussle between China and the United States has evolved into a tit-for-tat struggle to reduce their mutual dependence on each other. The US, in particular, has taken measures in recent years to curtail the influence of China-based tech giants.

In September 2022, the US government implemented restrictions on the sale of design software, semiconductor manufacturing equipment, and advanced AI chips from companies like Nvidia and Advanced Micro Devices (AMD) to Chinese firms. These restrictions aim to limit China’s access to advanced semiconductor technology, which is crucial for various industries, including smartphones. Additionally, the US technology companies that are beneficiaries of government funding will be prohibited from establishing “advanced technology facilities” in China for a period of ten years.

Furthermore, in November 2022, the Federal Communications Commission (FCC) introduced new regulations that prohibit the use of communication equipment from manufacturers such as Huawei, ZTE and Hikvision (manufacturer and supplier of video surveillance equipment). The ban was primarily motivated by grave concerns regarding the “unacceptable risk to national security” posed by authorizing the importation or sale of products from these companies in the United States. These measures reflect the US government’s efforts to safeguard its technological infrastructure and national security interests in the face of evolving global dynamics.

However, these bans on Chinese companies are not the first of its kind in the United States.

In May 2019, former President Donald Trump issued an executive order that effectively excluded Huawei from US networks by placing it on the Commerce Department’s Bureau of Industry and Security Entity list. The decision was motivated by concerns about Huawei’s close association with the Chinese government. To compound this situation, Google also barred Huawei from using the Android operating system on its smartphones. This ban had a significant adverse impact on Huawei’s smartphone sales and overall performance.

The year 2021 saw further action, with the FCC mandating all US telecommunications companies to discontinue the use of equipment from Chinese manufacturers, including Huawei and ZTE. Simultaneously, efforts were initiated to revoke China Telecom’s authorization to operate within the United States.

The United States’ laser-like focus on Huawei, among other tech giants, appears to have a clear motive. Huawei is a prominent Chinese tech company, and its CEO, Ren Zhengfei, is affiliated with the Chinese Communist Party (CCP), the political powerhouse in China. The sanctions imposed on Huawei have effectively blocked its access to crucial chip-manufacturing tools necessary for the production of advanced smartphone models. Consequently, this has led to a downturn in the company’s business, creating opportunities for competitors like Apple to increase their market share not only in the United States but also in China.

In December 2022, the US House of Representatives took a significant step by instructing its staff and lawmakers to remove TikTok from any government-issued mobile devices. This action was prompted by concerns over “security issues” associated with the widely popular video-sharing app.

Adding to the scrutiny, in March 2023, TikTok CEO Shou Zi Chew was summoned to testify before Congress to address apprehensions related to data sharing with China. These developments highlight the growing concerns within the US government regarding the potential risks associated with the use of TikTok and its data practices, especially in light of the app’s massive user base and its ownership by a Chinese tech company.

Every action tends to trigger a reaction.

China’s Retaliation

In May 2021, Chinese government agencies prohibited Tesla vehicles from their premises. This move was later followed by another incident in August 2023, where local media reported that Yueyang Sanhe Airport in Hunan province had banned Tesla vehicles from parking due to “confidentiality concerns.” Although drop-offs and pick-ups were still allowed, a circulating video showed a “No Tesla” sign at the airport’s parking lot. An airport service worker confirmed that this rule had been in effect for several months, adding that “many places have a similar rule.”

In response to the media attention and concerns, the electric car giant reassured its users that the anti-theft “sentry mode” feature in Tesla cars complies with China’s cybersecurity measures and the data generated by this feature is stored solely offline on the USB device located inside the car.

In May 2022, China issued a directive mandating that central government agencies and state-backed corporations replace foreign-branded personal computers and software with domestic alternatives by mid-2024. This order was enforced to bolster the local PC manufacturing and software development industries and as a precautionary measure to mitigate the potential consequences of future sanctions imposed by Western governments.

In May 2023, Beijing enacted stringent restrictions on Micron Technology, a chip manufacturer based in Idaho. These restrictions effectively prohibited Micron from selling microchips to companies in China, with the official justification being “serious network security risks.” It is important to note that China ranks as Micron’s third-largest market, accounting for about 10.7% of its annual revenue in 2022. Micron’s chips are widely used in China, in smartphones (iPhones) and personal computers. Even though these restrictions primarily impact sales to foreign companies that manufacture their products in China, a complete ban could have more far-reaching consequences. For instance, Apple heavily relies on Chinese manufacturing for the majority of its iPhones, making it vulnerable to any disruptions in the supply chain caused by such restrictions.

There have been numerous such instances in the last three years, mostly after the COVID-19 pandemic, where China has imposed bans on US-made products or the US has imposed bans on China-made products. These actions are often driven by a range of factors, including security concerns, economic considerations, or to support local industries. The interplay between these two economic giants in the global market continues to shape the landscape of international trade and technology.

American companies have been prompted to reassess their connections with China for various reasons in recent years. These include the tariff policies implemented during the Trump administration, Beijing’s stringent COVID-19 lockdowns, the ongoing US-China standoff over Taiwan, and political pressure to shift supply chains toward nations that align with Washington’s interests.

The World’s Factory: Witnessing Unprecedented Shift

Apple, much like many Western technology firms, has encountered the complexities of operating in China – popularly known as the world’s factory – and is frequently facing challenges related to censorship.

In November 2022, a change introduced in the iOS 16.1.1 update for Chinese users garnered attention and sparked debates. This change involved restricting the “Everyone” option in AirDrop to a 10-minute duration on iPhones purchased in mainland China, as reported by online users. Apple’s official explanation for this change was an effort to enhance the AirDrop experience by automatically reverting the receiving setting back to “Contacts Only” after 10 minutes. This adjustment was intended to help prevent unwanted file sharing. Critics have raised concerns that this change might be seen as Apple acquiescing to pressure from Beijing, especially as the “Everyone” option in AirDrop was used by protestors in China to circumvent censorship measures. Nevertheless, the Cupertino giant has stated its intention to introduce this capability to users worldwide in the near future.

In China, Apple has a history of implementing more stringent rules and guidelines on content-related services, including games and podcasts, as these areas are closely monitored and regulated by local authorities.

Despite the fraying ties between the United States and China, Apple continues to maintain a high level of dependence on China. This reliance is evident in two key aspects: China’s role as a manufacturing hub for Apple’s products and the significance of the Chinese market for Apple’s product sales.

Companies like Amazon.com Inc., HP Inc., Microsoft Corp., Cisco Systems Inc., and Dell Technologies Inc. also rely on China for hardware production, but their level of dependence is considerably lower than that of Apple. Even Korean giant Samsung, the world’s largest smartphone OEM, has significantly reduced its exposure to China. Samsung closed its smartphone factory in Tianjin in 2018 and its Huizhou plant in 2019. This move came after Samsung’s market share in China plummeted to less than 1 per cent in 2019, down from nearly 20 per cent in 2013.

In CY 2022, Apple, in an effort to reduce its reliance on China, started manufacturing the iPhone 14 in India. This marked a significant step in the company’s strategy to diversify its manufacturing operations beyond Chinese borders. However, according to Bloomberg Intelligence, making this shift is no easy feat. They estimate that it could take roughly eight years to relocate just 10 per cent of Apple’s production capacity out of China, given that nearly 98 per cent of the company’s iPhones have historically been made there.

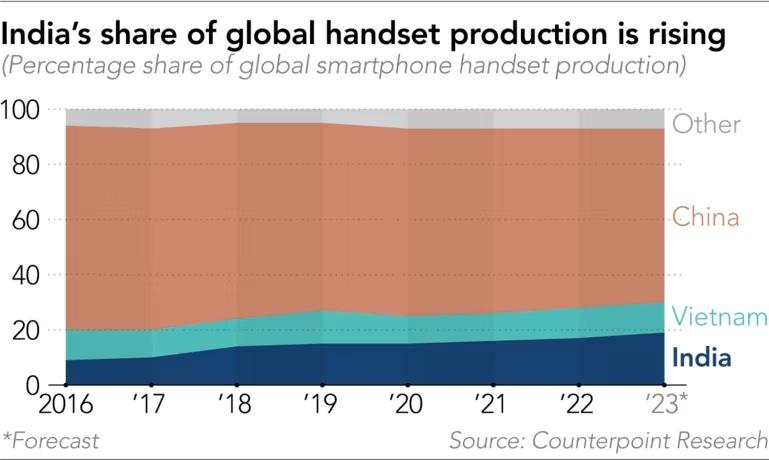

The challenge lies in the well-established ecosystem that China offers to Apple or any other smartphone company. It boasts an extensive network of local component suppliers, modern and efficient transportation infrastructure, advanced communication systems, and reliable electricity supplies. Exiting such an environment is no simple task. Due to this well-established ecosystem, China holds a dominant position in global smartphone manufacturing, accounting for a staggering 70 per cent of the market. Leading Chinese brands such as Xiaomi, Oppo, and Vivo are responsible for nearly half of all global smartphone shipments.

Amidst the odds stacked in China’s favour, the implications of Apple’s diminishing reliance on the country may appear modest. Yet, China appears resolute in preventing Apple from establishing an alternative production base, notably in India. This determination stems from the precarious state of China’s economic growth, where Apple’s decision to reduce production within its borders would reverberate through the nation’s employment landscape and its economy at large.

In early 2023, Apple delivered a directive to its suppliers, outlining plans to shift at least 20% of its annual iPhone production to India over the coming years, according to Nikkei Asia. This substantial transfer marks a notable departure from China to India, underlining Apple’s determination to relocate iPhone product development resources. This encompasses a cadre of thousands of engineers and the establishment of numerous state-of-the-art laboratories. On the other hand, the shift, while benefiting India, may lead to job losses in China and trigger a trend with far-reaching consequences.

Apple’s decision to reduce its dependency on Chinese supply chains also hinges on other critical factors. Foremost among them is the unrest that disrupted Apple’s production hub in Zhengzhou in October 2022, a consequence of a COVID-19 outbreak. Zhengzhou stands as the epicentre of Apple’s most extensive iPhone assembly operations, representing its most pivotal production site globally.

Now, let’s dig a little more into the Chinese smartphone market and Apple’s financials to understand how much revenue Apple generates from the shipments of iPhones in China.

iPhone Ban Will Shake Up Apple’s World

The love for Apple iPhones is primarily due to their premium quality and price, setting them apart from the competition. Their top-notch features, speedy operating system updates, and the secure iOS ecosystem consistently attract consumers willing to invest more in their devices.

“China is critical to Apple‘s success, but Apple is also critical to the Chinese economy,” Morgan Stanley analyst Erik Woodring said.

Apple’s reliance on China has expanded beyond the sales of iPhones within the country.

Globally, iPhones now constitute a substantial 52% of the company’s total annual revenue, amounting to a staggering $205.5 billion in FY’22. To put this into perspective, Apple’s overall revenue for the same fiscal year reached an impressive $394.3 billion. This underscores the pivotal role of the iPhone as the primary growth driver for the company.

As China exerts increasing pressure on Apple, signalling its discontent with Apple’s gradual shift of production away from its borders, it wouldn’t be unexpected for Apple to encounter production challenges for the iPhone within China. This potential transition could wield a direct and immediate influence on Apple’s intricate supply chain, subsequently impacting iPhone sales on a global scale.

Besides, China’s contribution to Apple’s overall global revenue is as high as 20% in any quarter. In FY22, Apple generated a substantial $74.2 billion in revenue from China, representing 18.8% of its worldwide revenue. This makes Greater China (including China, Hong Kong and Taiwan) Apple’s third-largest market, trailing behind the Americas and Europe. Recent government actions have left us wondering how much of that chunk came solely from iPhone sales, which are now facing bans and restrictions.

Now, let’s zoom in on the shipments of iPhones in China. Interestingly, the country accounts for nearly one-fourth of all iPhones shipped worldwide during the June quarter. During Q2 2023, approximately 10.1 million iPhones found new homes in China, marking a 6.1% year-on-year growth. According to the IDC, Apple captured a solid 15.3% share of China’s smartphone market, making it the fourth-largest player in the country.

Looking at the broader picture, in CY 2022, the Cupertino giant shipped 48 million iPhones in China, constituting 16.8% of all smartphones shipped in the country. On a global scale, China accounted for 21.2% of all iPhones shipped worldwide.

The above-mentioned data show that Apple has so far enjoyed robust demand for iPhones among Chinese consumers and reliance on China to satisfy its supply chain worldwide. However, things are about to change dramatically after the Chinese government’s announcement of a ban on iPhones within government agencies and state-owned enterprises, with indications that this prohibition may soon extend its reach. If the Chinese government were to implement a sweeping ban on iPhones, it would unquestionably deliver a significant blow to Apple’s revenue. The Cupertino-based smartphone giant is most likely to face reduced demand for its much-awaited iPhone 15 series in China, considering many people who were about to buy or upgrade to the upcoming iPhone may now hesitate due to the recent ban.

China Bans iPhones: A Boon for Huawei

Experts are pondering whether China’s actions are strategically timed or merely a matter of coincidence. China has begun asserting its influence at a juncture when Huawei is nearing completion of the initiatives designed to mitigate the effects of restrictions and bans imposed by the US.

If China imposes a complete ban on Apple iPhones, it could potentially open the door for Huawei to reap significant benefits. What sets Huawei apart from other Android OEMs, such as Xiaomi, Oppo, etc., is its unique position as a premium smartphone giant with strong ties to the Chinese Communist Party (CCP).

The timing of the ban on iPhones in China’s official workplaces coincides with Huawei’s recent launch of the Mate 60 and Mate 60 Pro smartphones. The Mate 60 Pro, in particular, boasts impressive features, including a triple rear camera setup (comprising 50MP, 48MP, and 12MP lenses), a 13MP front camera, a robust 5000 mAh battery, and is powered by a chip from Semiconductor Manufacturing International Corp (SMIC). These jaw-dropping features of the Huawei Mate 60 series offer a tempting alternative to the iPhone Pro models and have the potential to disrupt the premium segment of the Chinese smartphone market. As a result, an increasing number of Android smartphone users are expected to upgrade to Huawei’s latest devices, with even existing iPhone users in China contemplating a switch back to Huawei’s enticing offerings.

Given its close government connection, Huawei could receive preferential treatment and support compared to other companies. This support could manifest in various forms, including regulatory advantages, access to crucial resources, or government-backed initiatives. According to the Semiconductor Industry Association, Huawei began producing chips in China in 2022 while getting an estimated $30 billion in state funding from the government and its hometown of Shenzhen. The company has already acquired two existing chip-making plants and is building three more.

Huawei’s resurgence in the Chinese smartphone market is a testament to its potential. Interestingly, in Q2 2023, it climbed into the Top 5 smartphone vendors in China, boasting an impressive 76% year-on-year growth in shipments. This growth propelled Huawei’s market share from 7.3% in Q2 2022 to a robust 13% in Q2 2023. Huawei’s success could be attributed to a more aggressive product launch strategy, featuring standout devices like the P60 series and the foldable Mate X3 model. These innovations could further bolster its appeal among Chinese consumers.

Before the US government’s full ban on Huawei, the company commanded an impressive share of nearly 20% of the worldwide smartphone market and an astonishing 40% of China’s smartphone market.

In a Nutshell

In conclusion, the high-stakes clash between China and the United States in the tech industry has far-reaching implications, and Apple finds itself at the intersection of these complex forces. The potential ban on iPhones within Chinese government agencies and state-owned enterprises underscores the significance of this issue. As Apple navigates these challenges, its relationship with China, both as a manufacturing hub and a vital market, remains crucial. To mitigate risks associated with geopolitical tensions, the Cupertino giant might need to expedite its efforts to shift some manufacturing operations from China to other countries, like India and Vietnam, to reduce its dependence on a single location. Meanwhile, Huawei, with its premium offerings and close government ties, is well-positioned in order to gain a sizeable share of China’s smartphone market.

As these tech giants adapt and vie for dominance, the world watches closely, recognizing that the future of technology and geopolitics is being written in real time. Now, it would be interesting to see how Apple will adapt to these shifting dynamics and what innovative strategies it will employ to maintain its global presence.