India’s digital advertising sector is experiencing remarkable growth, with Alphabet’s Google and Meta maintaining their dominant positions over the years. However, as consumers’ shopping preferences have changed in the last few years, particularly during the covid-19 pandemic, Amazon has strategically expanded its services in the digital ad space to entice more customers to its e-commerce platform. This calculated move has resulted in Amazon slicing a significant portion of India’s digital advertising pie that was once exclusively enjoyed and dominated by Google and Meta.

As reported by ETPrime, advertisers are adopting a strategic approach to how they distribute their advertising budget, with a particular focus on digital channels. This trend is particularly evident in industries such as consumer packaged goods and direct-to-consumer brands. Notably, advertisers in these categories are shifting a substantial portion, approximately 15% to 20%, of their overall advertising budget from Google and Meta to Amazon’s offerings. This strategic shift underscores the evolving preference for Amazon’s ad solutions as an effective means of reaching their target audiences and achieving their marketing objectives.

In the current landscape, Google and Meta collectively maintain a duopoly with an astonishing 90% share of India’s digital advertising market valued at Rs 70,000 crore. Although Amazon’s share is comparatively smaller, accounting for less than 10%, it still holds significant weight when compared to other digital channels such as Flipkart, Instagram, Myntra, Nykaa, and more.

Amazon’s foothold in the digital ad market in India continues to expand, putting forward stiff competition to both Google and Meta, the established tech giants.

Let’s dig deep to understand the significant factors behind the advertisers’ preference for Amazon India over Google and Facebook’s parent Meta.

Factors Contributing to the Growth of Amazon Ad Business

The Covid-19 pandemic has significantly transformed the way people approach shopping. An increasing number of consumers now first search for products on the internet, followed by extensively reading reviews and feedback, before eventually making online purchases. This shift in behaviour is noteworthy.

With Amazon standing as a dominant force in the e-commerce arena, it has naturally become the primary destination for online shoppers. Consequently, consumers are increasingly bypassing the traditional approach of initiating a search on Google first and then exploring other e-commerce options. Instead, they are directly navigating to the Amazon app or website, capitalizing on the convenience and extensive product offerings it provides. This trend underscores Amazon’s pivotal role in the modern shopping landscape, where it not only shapes shopping behaviour but has also become the preferred destination for an expanding pool of online shoppers.

Marketers are becoming increasingly aware that Amazon stands as the sole competitor to Google in the present landscape. This is primarily because people use the Amazon platform for their searches with a clear intention to make purchases, according to Mayank Shah, Senior Category Head of Parle Products.

Another reason is the data-driven targeting ads. Amazon possesses a vast trove of consumer data, including shopping habits, preferences, buying power and purchase history. This granular data enables advertisers to create highly targeted campaigns, reaching users based on their specific interests and behaviours. Amazon’s ads seamlessly integrate into the user’s shopping journey, ensuring high contextual relevance. Ads appear when users are exploring related products, making them more likely to engage and convert.

In fact, a substantial number of individuals have openly acknowledged that the advertisements on social media platforms and other promotional content on Google and e-commerce websites, featuring product details, discounts, and appealing offers, serve as catalysts driving their shopping activities.

Another contributing factor behind advertisers favouring Amazon over Google and Meta for their advertising campaigns is the concept of Lower-funnel marketing. Traditionally, marketers have leaned towards Google and Meta for “upper funnel” marketing aimed at building brand awareness. However, given the prevailing economic challenges and intense competition within consumer goods sectors, advertisers are now shifting their focus to lower-funnel marketing, which emphasizes sales-oriented approaches to achieve quicker results.

The growth of Amazon’s advertising platform isn’t solely attributed to an increased volume of ads on Amazon’s platforms or rising ad costs, although these factors do play a role. Rather, Amazon’s advertising expansion is a result of the broader reach of its network, extending even beyond Amazon’s own platforms and encompassing various strategies beyond just bottom-of-the-funnel ads.

In the year 2020, Amazon introduced its global ‘demand-side platform‘ (DSP) to the Indian market. Amazon DSP allows advertisers to buy programmatic ads, enabling them to connect with both new and existing audiences both within and outside of Amazon’s platform. This innovative tool leverages data from Amazon’s diverse array of properties, including Prime Video, Fire TV, Kindle, Alexa, Audible, and more. This comprehensive integration of data sources facilitates more precise audience segmentation, empowering advertisers to tailor their campaigns with heightened accuracy.

In 2022, Amazon allowed brands that aren’t part of the Amazon ecosystem, such as restaurants or hotels, to advertise on its live-streaming platform, Twitch. This expansion highlights how Amazon’s advertising network is branching out further, both within and beyond its own ecosystem, providing marketers with diverse avenues to engage their target audiences. This broader network expansion contributes to the notable growth of Amazon’s advertising offerings.

The trend of clients gravitating towards Amazon’s advertising offerings is evident. Presently, around five to six out of every ten media plans at Publicis Media incorporate Amazon Ads targeting strategies. L’Oréal India, for instance, initiated its association with Amazon by listing its brands on the platform around 2016-17. Parle Products hasn’t directed its advertising budget towards Amazon ads as yet, ASAP energy bars – a direct-to-consumer (DTC) brand under WIMWI Foods in which Parle has invested – has been allocating funds to Amazon ads. The results have been promising, with the brand witnessing a favourable sales response. This shift in advertising strategy underscores the appeal and effectiveness of Amazon’s ad solutions in driving tangible business outcomes for diverse brands and businesses.

Now let’s dig deeper into the digital ad industry, globally and in India, and how much revenue Amazon generates yearly from its ad business compared to Google and Meta.

India’s Digital Ad Industry

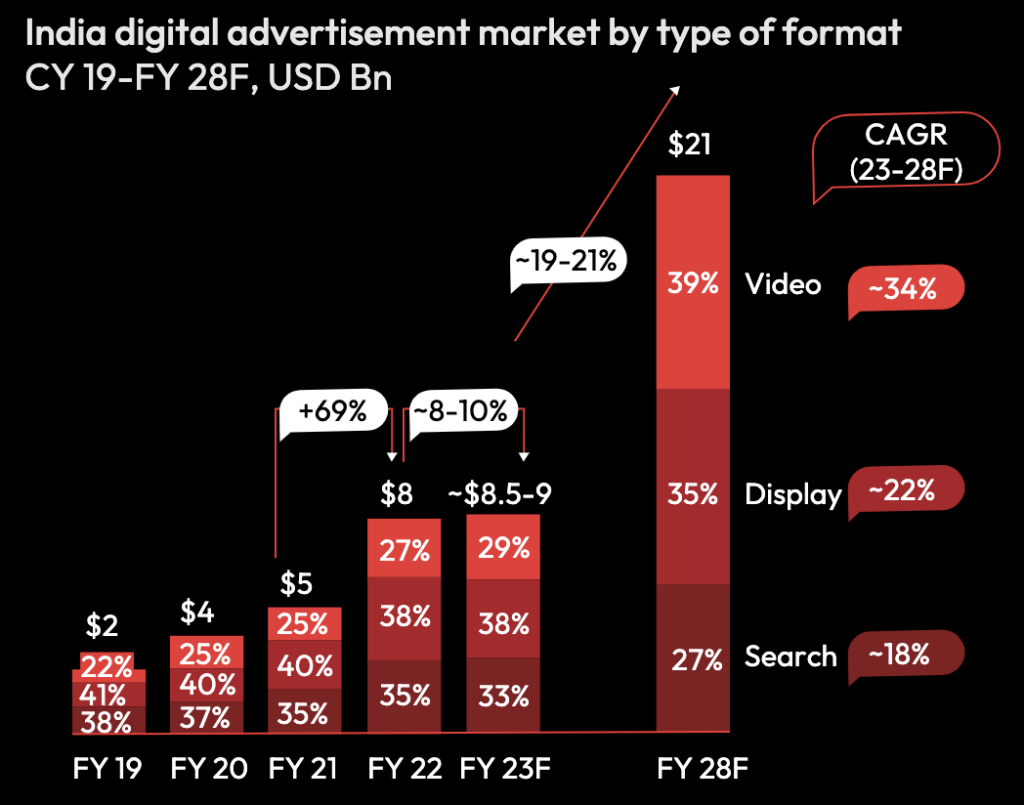

The advertisement industry in India experienced a digital revolution over the past decade, fueled by the rapid proliferation of smartphones and internet access. It has moved from basic search ads to visual display ads and has now expanded to include video ads.

Redseer Strategy Consultants predict a remarkable growth trajectory, with digital ad spending in India projected to expand 2.5 times, reaching a substantial $21 billion by the year 2028.

On a global scale, Amazon’s advertising business has consistently surpassed the growth of Google’s and Facebook’s (Meta) for the past three years, demonstrating its remarkable expansion. Amazon’s global advertising segment has displayed sustained double-digit growth in revenue both on a quarterly and yearly basis.

In 2022, Amazon’s advertising services revenue grew 21.1% YoY, amounting to $37.74 billion worldwide. This growth trajectory continued into Q2 of 2023, where the company recorded $10.68 billion in revenue, marking a significant 22% YoY growth.

However, when compared to the top two industry giants, Amazon’s ad revenue is still small in portion.

Google’s advertising revenue grew 7.15% YoY in 2022 to $224.47 billion worldwide. In Q2 2023, the company generated $58.14 billion in revenue, with 3.3% YoY growth. Meta generates a majority of its revenue from its ad business. The social media giant generated $28.15 billion in Q2 2023, declining a notable 10.62% YoY. If we see the whole year’s picture, in 2022, Meta’s global ad revenue declined 1.12% YoY to $113.64 billion.

The revenue growth figures presented above provide undeniable evidence of the significant expansion of Amazon’s advertising business, which is now positioned as a formidable challenge to industry heavyweights like Google and Meta.