Shades of Deja-vu? Seen this situation unfold before? Anybody can be forgiven for asking twice, but are we really buying Facebook’s limited data sharing claims, again?

The much-celebrated Reliance Jio-Facebook deal is creating waves, still.

Upon being questioned as to the specifics of their deal with Reliance Jio Platforms by the Competition Commission of India, Facebook has assured that data sharing is only going to constitute a “limited part of the deal”.

Taking the potential deal into view, the antirust custodian had fairly put forth questions citing facts that both Reliance Jio Infocomm Limited and Facebook being leading players, the magnitude of the deal involved a symbiotic interface with substantial user data possessed by entities. While Jio is a prominent telecommunications company hogging more than one-third of the country’s mobile users on its network, CCI acknowledged Facebook’s muscle in online advertising services.

While Facebook was quick to issue a statement saying that the data sharing is in place solely for the purpose of facilitating eCommerce transactions on JioMart, as per the initial agreement between the two parties, it has been sternly forewarned by the CCI to work in compliance with the dynamics of the concerned market adding that any anti-competitive indulgence will be met with appropriate sanctions as per Section(s) 3 and/or 4 of its Act.

Jaadhu Holdings LLC, – a new entity of Facebook through which it invested in Jio Platforms – has maintained that neither company will be acquiring each other’s data, and that the primary purpose of the deal was not such. As per their proposed commercial arrangement, Facebook-owned WhatsApp and JioMart, owned by Reliance Retail Ventures and operated by Jio Platforms, will send and receive only “limited data” with each other.

CCI’s suspicion was piqued not just because of the fact that transactions can result in unrestricted access to each company’s resources, more so because of the incentives which lie in mutually beneficial data sharing. Facebook’s unit emphasised that the Master Services Agreement drawn explicitly prohibits all partners from using confidential information received from the other side for their own business purposes or disclosing it to third parties.

Facebook: A Repeat Offender

All these developments are unsurprising, given the scanner that the Zuckerberg led company has been under and the increasing number of high profile scandals it has been embroiled in. Facebook and trust are increasingly been seen as being at two opposite end of the poles by users worldwide, as evidenced by multiple studies.

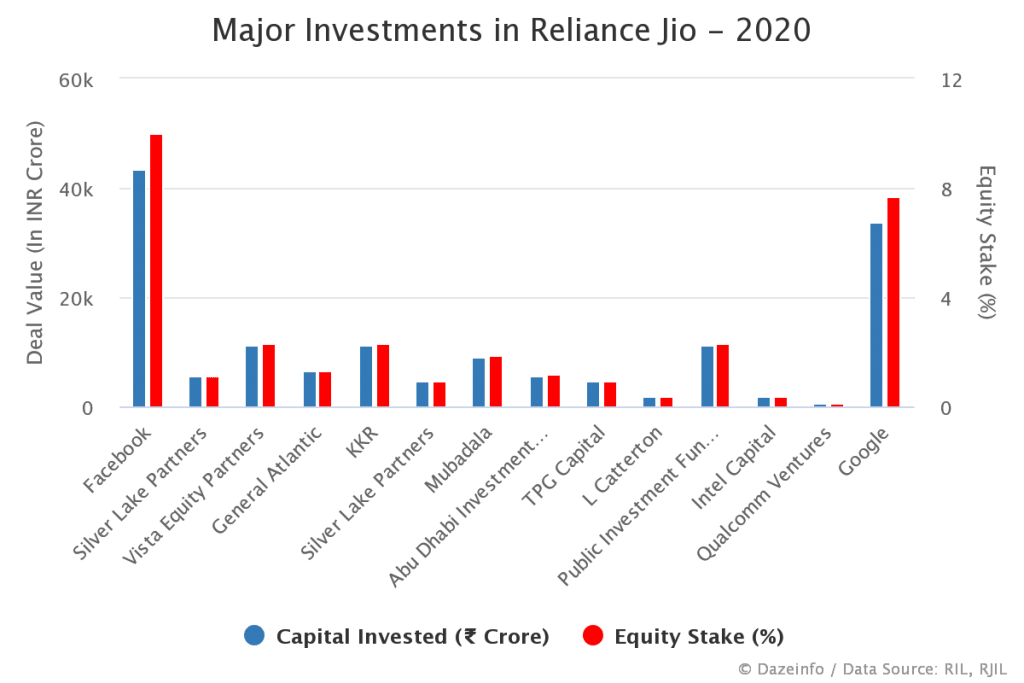

As for Reliance, the investment worth Rs 43,574 crore by Facebook for 9.99% stake in Jio Platforms was the first in a series of 14 deals secured by Reliance Industries’ digital arm and was executed by the social media giant’s subsidiary Jaadhu Holdings. Announced on April 22, the deal made Facebook the largest minority shareholder in Reliance Industries.

In total, Reliance Industries has so far committed Rs 152,056 crore for a combined stake sale of 33 per cent in Jio Platforms Limited aka JPL.

Reliance has really been on a deal clinching spree, with Google also filing for approval from CCI for its INR 33,737 Cr investment in Jio Platforms for a 7.73% stake in the company. Google has informed CCI that its investment in Jio Platforms is for manufacturing a new smartphone in India.

Now that the CCI has blessed Reliance Jio-Facebook deal, it is sure to be set to examine many more presented by Reliance in the coming days. It will be interesting to see what the Reliance juggernaut gets up to next.

As far as Facebook’s commitment of being restricted to “limited data sharing” is concerned, it is anybody’s guess to know what are Facebook real intentions are with the investment in Jio platforms.

What’s your take about Facebook’s assurance to CCI? Do you think Facebook can be trusted and sensitive personal data of 398 million subscribers of Jio is in safe hands?

Do let us know your views in the comment section below.