Amazon.com, Inc. (NASDAQ:AMZN) is currently valued at $800 billion – the third most valued tech firm, trailing behind only Microsoft and Apple – the two tech behemoths.

Jeff Bezos, CEO and Founder – Amazon.com, toppled Bill Gates, Founder of Microsoft, to become the richest person alive on this planet last year.

To top it all, in fiscal 2018, the company reported a net income of $10.07 billion, with a whopping 232% YoY growth.

The company’s U.S. profit before income tax increased to $11.2 billion in fiscal 2018, with a massive 98.2% YoY growth.

Any guesses for how much this global giant will pay by way of federal taxes this year?

An astronomical huge $0!!

Yes, you read it right!

While ordinary people like you and I, in spite of our meagre incomes, have been paying tiny amounts to the state exchequer year after year by way of taxes, this global giant will be walking away without paying a cent for the second year in a row.

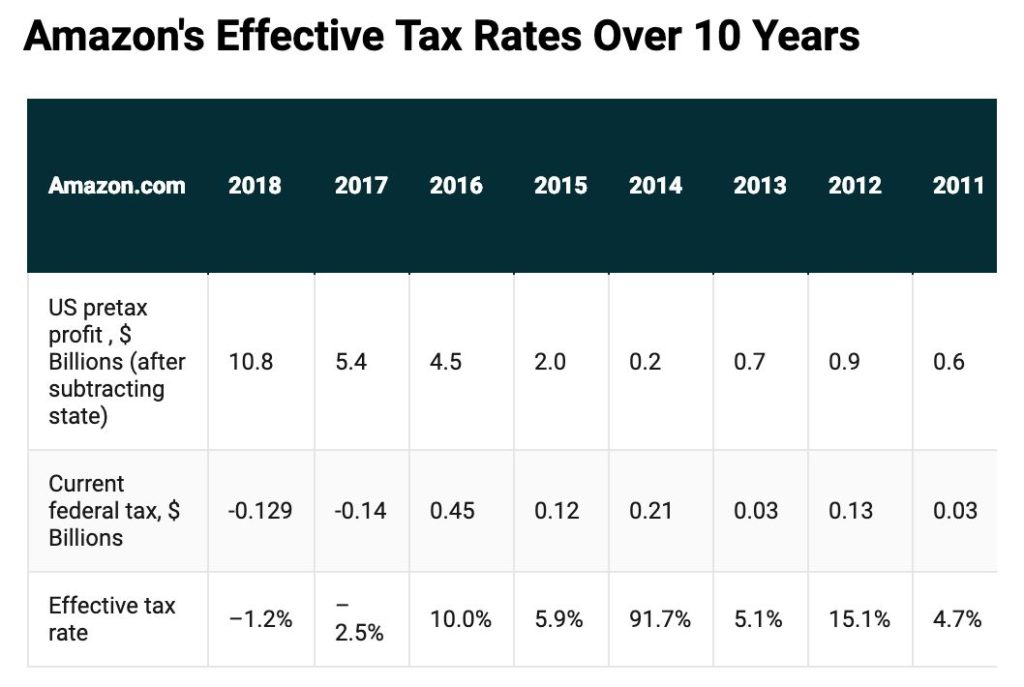

Thanks to an absurd mix of exemptions, rebates, loopholes and tax credits which the company has exploited to the fullest, it actually reported a U.S. federal income tax rebate of $129 million. That makes its interest rate -1.2%!

Amazon $0 Tax Liability – Are You Serious?

As per a report published by the Institute on Taxation and Economic (ITEP) policy Wednesday, the U.S. based Amazon.com will walk away without paying a single dollar by way of federal taxes for the second successive year. This despite the fact that it doubled its U.S. profit from $5.6 billion in 2017 to $11.2 billion for 2018.

Amazon’s consistent policy of tax avoidance has long been lambasted by experts and politicians like. Even President Donald Trump blasted the company on Twitter by saying it paid “little or no taxes to state and local governments”.

And though the President’s volley of tweets against the global giant brought its shares down by 9%, the IETP holds his government’s policies responsible for the non-existent tax rate.

According to the ITEP report, the Tax Cuts and Jobs Act of 2017 lowered the corporate tax rates from 35% to 21%. At the same time, it came with a barrage of loopholes which allowed even “profitable companies to routinely avoid paying federal and state income taxes on almost half of their profits.”

“This is another situation where the rhetoric from President Trump is completely divorced from what he does and what his policies do,” pointed out Steve Wamhoff, ITEP’s Director of Federal Tax Policy.

The existing -1.2% federal income tax rate is way lower than the already low 11.4% which Amazon paid between 2011 and 2016, as per The Week.

How Did Amazon Pull This One-Off?

It all began earlier this year when Amazon reported that it did not owe a single penny by way of federal taxes on the profits generated by the company on the American soil for both 2017 and 2018. It also went on to state that it was, in fact, due for rebates from the federal government.

The company explained that its tax burden had fallen because of the depreciation of assets and deductions for stock-based compensation.

While the company has certainly attracted a lot of negative publicity because of having found out ways to reduce its overall tax burden, the company reported owing $322 million in taxes to various U.S. State governments and another $563 million in the rest of the world for 2018.

Amazon pays nearly 2.9% by way of state taxes.

“That’s certainly bigger than zero,” pointed out Matt Gardner, one of the people who produced the ITEP report.

Amazon, on its part, has denied evading any taxes. Jodi Seth, one of the official spokespeople of Amazon, has tried to downplay the matter by explaining how much Amazon is committed to the US market and its contribution to the country’s growth in the past many years.

Jodi didn’t forget to mention $125 billion invested Amazon has made in the US since 2011. He claimed that the major chunk of the investment went into building network of more than 125 fulfilment and sortation centres, air hubs and delivery stations as well as cloud-computing infrastructure and wind and solar farms.

Jodi was indirectly explaining the vital role Amazon has been playing in the US economic growth and stability.

Corporate tax is based on profits, not revenues, and our profits remain modest given retail is a highly competitive, low-margin business and our continued heavy investment.

This is not the first time Amazon has been in the news for tax evasion or avoidance, whatever way one chooses to call it.

Tech giants like Google, Facebook and Uber too have been accused of employing smart lawyers to help them take advantage of legal loopholes to bring down their tax liabilities.