Silver linings are clearly in short supply in the pandemic fuelled world that we have come to know. In a rare exception, one can safely use the term for the online food and grocery market, which borne of this time and is portended to thrive in the coming years.

Such auspices are all the more credible as found by a report by Redseer in conjunction with BigBasket, titled ‘Online Grocery: What Brands Need to Know’. As per the predictions, the online grocery delivery market in India is on its way of reaching to the tune of $18.2 billion in 2024, a six-fold increase from an estimated $3 billion in 2020.

The report highlights that the online grocery market in India will account for 2.3% of the overall food & grocery market, which is projected to scale a staggering size of $790 billion in 2024.

The landscape of the food and beverage industry in India is still heavily skewed in favour of the roadside Kirana stores and local grocery shops, which is enamoured by an efficient and time tested supply chain. If the reports are anything to go by, prominent players like BigBasket, Grofers, Reliance Mart and others are set to make huge inroads in the sector.

Some of the key findings which provide a comprehensive measure of the online grocery market in India:

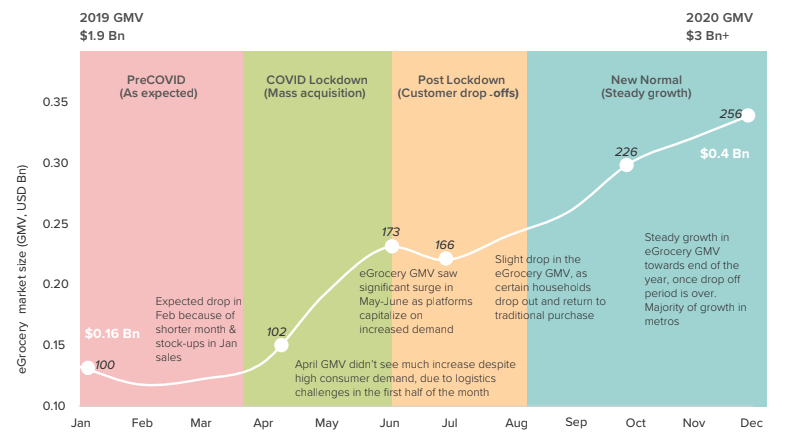

- The gross merchandise volume (GMV) on e-grocer platforms increased by 72%, from $179.9 million in January to $311 million in June this year.

- Fresh food categories were the cause of the exponential jump of 144% between June and January.

- Estimates suggest the GMV rising to $3 billion by the end of 2020 itself.

- Demand for comfort food like noodles and cookies, immunity boosters like lemon and hygiene products like sanitizers has soared.

- The sales of Snacks and branded foods jumped to 75% in the June quarter, as compared to 5% pre Covid19.

- Biscuits and cookies were the largest sub-category and grew the most in Q2.

- Beverages grew by 2% quarterly pre-Covid19, growth jumped to 50 per cent in Q2.

- Personal Care grew by 5% quarterly pre-Covid19 but jumped to 24 per cent in Q2 due to Covid19.

Covid-19 has pushed the fast forward button for the sector and online commerce, and e-grocery have reaped the most out of it. Digitisation has been the key to driving such growth, while on the other hand, it augurs a toll on the traditional retailers, with them seeing bleak increments at 5%.

This is evidenced by the fact that the share of online grocery market in India is slated to increase by 8X, at a CAGR of 57%, between 2019 and 2024.

After the infancy phase when few players tried to scratch the surface of the potential market which is now estimated worth billions of dollars, the ball roll started rolling at a much faster pace from 2014. The market grew from just $500 million to $1.9 billion between 2014 and 2019.

With 100% FDI pumping huge capital in the food processing sector, the online food and grocery market in India has seen new heightened levels of activity, with Amazon, Flipkart, Milkbasket etc. joining in the slew of newer recruits. Undoubtedly, such developments have given a massive boost to online and retail food and beverages business. Coupled with other factors around investment in the supply chain and expansion into smaller cities, the signs are all promising.

Reliance is practically leaving no stone unturned to expand and capture the eGrocery market in India. RIL’s retail arm Reliance Retail has raised Rs 13,050 crore in September besides acquiring the retail giant Future Group – one of the largest retail acquisitions in India. The company recently launched JioMart app top tap the growing online grocery market in India and within a short span of 3 months the app clocked 5 million downloads, thanks to the pandemic.

Not to be left behind, large online players like Zomato and Swiggy have also dabbled their fair bit in the sector during the pandemic, all with an eye on making future moves for eGrocery services.

Changing consumer consumption preference, with an increasing affinity towards online services because of Covid19, has served these services well. Specifically, consumer segments who find value in online grocery include working couples who use these services to save time and for comfort, bachelors living in shared accommodation, working urban mothers who have shown a strong preference for online shopping because of saving time, and Tier II consumers who have found varied choices.

With the panic and the apprehension, calls of maintaining social distancing wherever we set foot, it looks likely that the online grocery market will be one exception which will continue to make hay even beyond this time of crisis. Stay tuned to this space for more updates.