The number of online shoppers in India will rise at rapid pace in the next five years.

India’s online retail sphere has become a topic of intrigue and opportunity in recent years, with entrepreneurs, corporations, and small scale industrialists alike realising the potential of the market.

This growth hasn’t emerged in isolation. It is majorly attributed to cheap mobile data plans that made the internet accessible to a large segment of the population. Additionally, e-retail has become overwhelmingly accessible with giants like Flipkart and Amazon serving customers from all city tiers. Amazon delivers to more than 20,000 pin codes in the country, whereas Flipkart’s deliveries are available to 80-100% of all serviceable Indian pin codes, depending on the product category. Small scale industries are also catching up and scaling up their businesses to offer online services.

A report by Bain & Company in collaboration with Flipkart published on Tuesday projected India’s online consumer base to reach 350 million in the next 5 years.

7th Highest e-Retail CAGR in the World

According to the report, based on the CAGR of online retail penetration in e-retail industries world over, India ranked 7th in 2019, growing approximately 36% every year.

India is currently in the “massification” stage of its e-retail journey, based on a model that divides the maturation of e-retail industries into 3 stages.

Thus, according to this model, India’s accelerated e-tail growth is in its intermediate phase where consumer penetration is increasing due to wider access to data due to lower data prices and an improvement in e-retail infrastructure and interface.

Key Takeaways

The report highlighted several defining points to note about the present and future of the Indian online shopping microcosm.

The Present

- Currently, the cumulative percentage of pin codes served by e-retailers is 95%. 3 out of 5 customers come from tier-II cities.

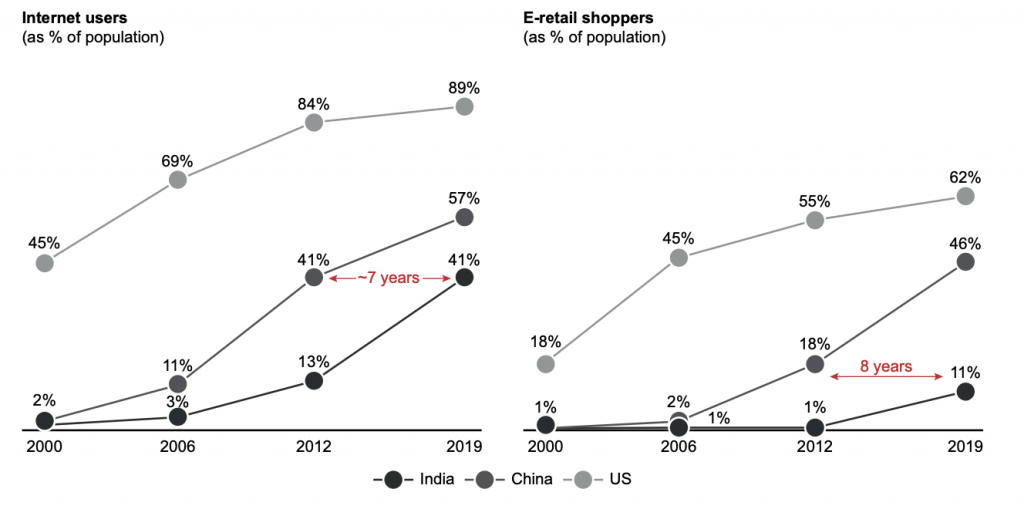

- India’s e-retail growth is following a similar pattern to China’s, which is now a mature e-retail industry.

- It is predicted that the most in-demand product categories will be fashion and footwear, general merchandise, electronics, and furniture, in that order. It is worth noting that similar findings were produced by a RedSeer report in 2019.

- Users visit anywhere between 20 – 50 product pages while shopping. Specifying keywords vary depending on the product category.

- E-retail reaps benefits for both, consumers and service providers. It has broadened the reach of small businesses, revived dying industries, and offers a wide range of affordable and/or branded goods to customers. Additionally, digital-native brands like boAt have seen tremendous growth.

The Future

- By 2025, the number of online shoppers in India will increase up to 350 million with the GMV of the industry hitting $120 billion. Along with cheap data plans and better online infrastructure, this growth would also owe to the majority of the digital population coming-of-age and becoming financially independent.

- Based on user statistics, an average user spends up to 9 minutes on the platform per visit. Approximately half the customers are more likely to view the image gallery, as opposed to 1 in 15 who read product descriptions. The report holds that this data is essential in designing UI improvements in the future.

- Consumers are increasingly likely to discover new products online, a finding that bears implications for advertising.

- Voice, image, and vernacular (regional language) searches are becoming more common as more tier-II and tier-III cities are being delivered to. This means applications will have to become more inclusive in terms of language and mode of search.

The above projections clearly paint a rosy picture for all the existing eCommerce players in India. India has over 500 million internet users now and considering the above figures, it’s quite evident that players have scratched the surface only. In the next few years, as the number of online shoppers in India will increase, there would also be a huge window of opportunity for individual brands to have their own eStore setup in place and rely less on marketplaces such as Flipkart and Amazon.

While e-retail is expected to suffer an approximate loss of $1 billion in the coming times due to the COVID-19 outbreak, it seems that the industry is far from coming to a halt.