As technology has advanced, so has the number of cybercriminals finding ways to loot people. The latest report by CloudSEK has unveiled a complex web of intrigue involving Chinese cybercriminals who’ve set their sights on India’s financial ecosystem. A group of Chinese cybercriminals are found to be targeting Indian loan seekers through over 55 deceptively malicious Android apps.

In the short span from July 22 to September 18, 2023, these Chinese scammers operating in India claimed to have buckets of money for loans with a staggering combined value of Rs 641 crore. Their scheme, while undeniably clever, has proven to be exceptionally effective, enabling them to amass a total of INR 37 lakhs thus far.

What makes this case even more perplexing is the global reach of their operations. Chinese cybercriminals have set up a complicated network of 22 obscure payment gateways scattered across various countries, including Indonesia, Malaysia, South Africa, Mexico, Brazil, Turkey, Vietnam, the Philippines, and Colombia. The scammers used these hidden channels to move their ill-gotten money, making their operation even more complex and puzzling.

The Cybercriminal Playbook

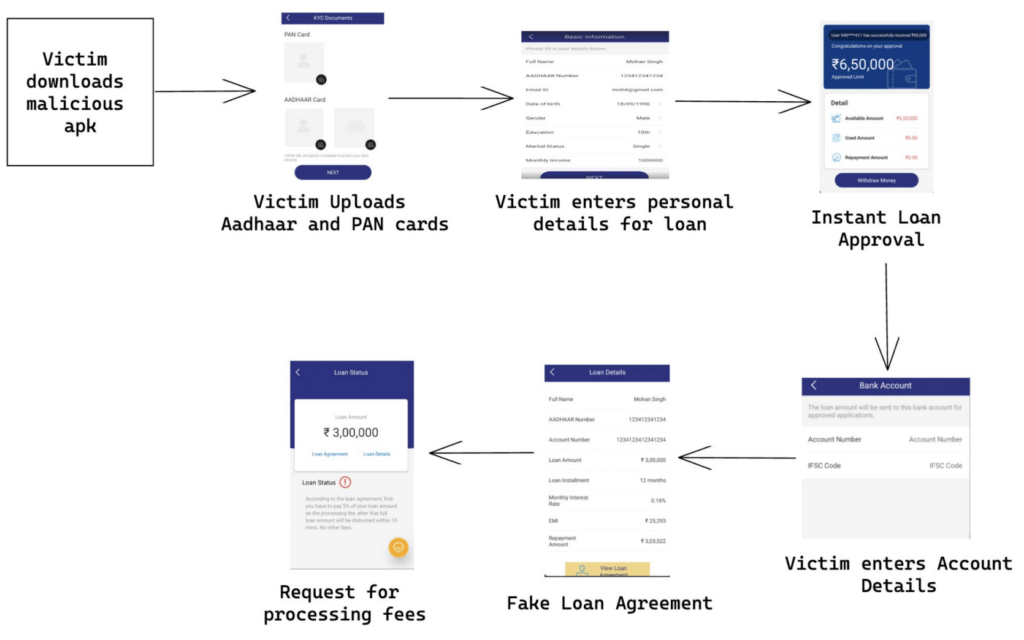

The cybercriminals’ playbook begins with the creation of counterfeit instant loan apps. These apps, seemingly offering a financial lifeline, promise substantial loans with flexible repayment terms. However, the catch is that they’re nothing more than digital mirages, designed to trap the desperate and the unsuspecting.

As victims install these deceptive apps, they unwittingly share their personal information, including their names, addresses, phone numbers, and bank account details. By harvesting the sensitive personal data of millions of people, these scammers are ready to sell the database to all sorts of companies operating legally and illegally.

But that’s not where the subterfuge ends. The malicious apps go further, manipulating users into granting access to their contacts and other sensitive data stored on their mobile devices.

In a particularly audacious move, victims are asked to pay a processing fee, typically around 5% of the promised loan amount. Once that fee is handed over, the cyber scammers vanish into the digital shadows, and the promised loan remains as elusive as ever.

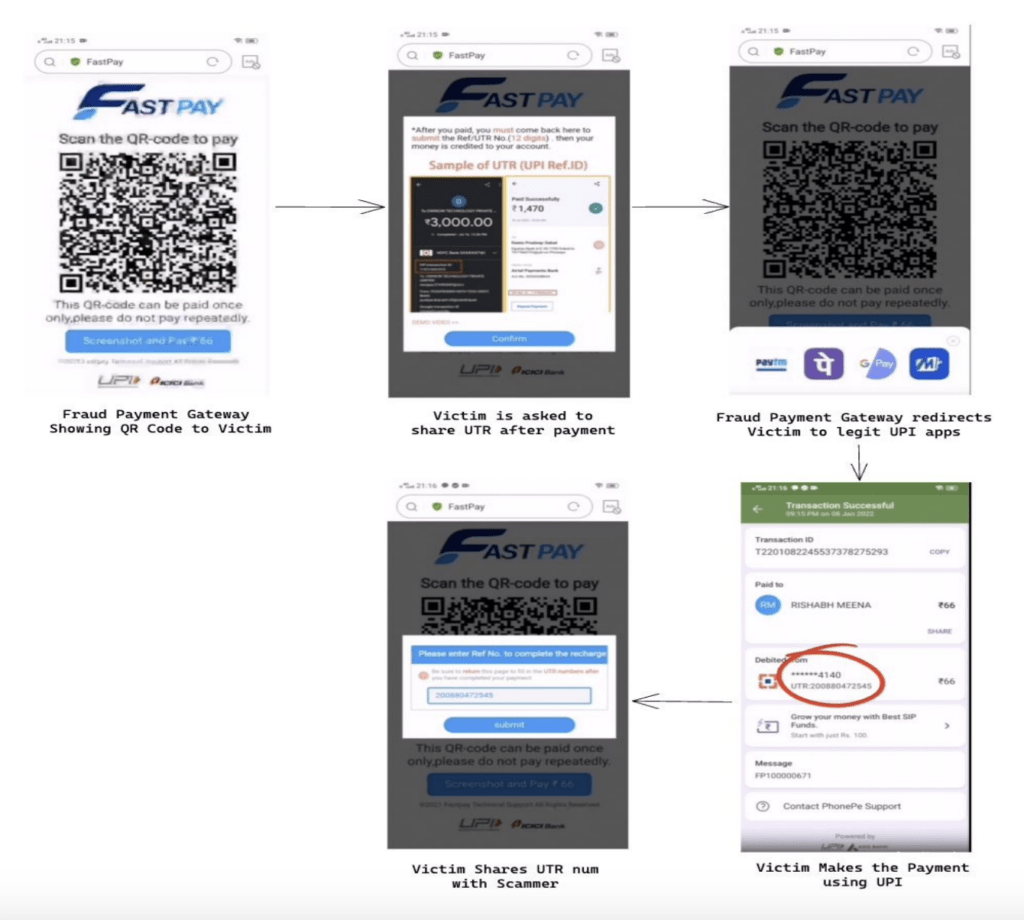

The stolen funds are routed through digital pathways, such as UPI, or more traditional methods like debit cards. Subsequently, these funds are disbursed to different beneficiaries, encompassing hawala networks, scammers, or other entities operating within India. These fraudulent actors maintain a foothold within India, primarily to facilitate the collection of SIM cards and bank accounts, which are vital elements in the money laundering operation.

Regulatory Gaps and the Call for Reform

Perhaps the most critical aspect of this scam is how these scammers keep changing their tactics. As the authorities and legal scrutiny tighten their grip on cybercrime, these culprits have become experts at evading detection.

They use more sophisticated methods to outsmart law enforcement and continue their illegal activities. It’s like a cat-and-mouse game in the world of cybercrime, with the criminals staying one step ahead.

Moreover, the recent loan scam saga underscores a significant regulatory loophole. Presently, UPI service providers in India operate without coverage under the Prevention of Money Laundering Act (PMLA), which these scammers exploit to conduct illicit transactions. This conspicuous gap in the system demands urgent attention and reform. At the heart of this operation are Chinese payment gateways, which demonstrate exceptional finesse in exploiting the QR code functionality within the UPI (Unified Payments Interface).

In the ongoing battle against the surging wave of cybercrimes in India, there’s a call for collaboration between Banks and the National Payments Corporation of India (NPCI) to introduce enhanced security measures. One pivotal step in this endeavour could involve a rigorous verification process, ensuring that any newly registered mobile number aligns with the account holder’s name. This measure will act as a safeguard, effectively thwarting scammers from manipulating phone numbers to gain control.

Additionally, when it comes to UPI service providers, such as Paytm, PhonePe, GooglePay, etc., there’s a growing recognition of the need to bolster security measures, shielding users from the clutches of fraudulent activities.