Google Pay has been treading in hot water over a Public Interest Litigation as of late.

The company is accused of sharing Google Pay users’ transaction details with third-party advertisers, touting a threat to users’ privacy and data.

It all started with a PIL that is filed in India against the UPI Payments’ app from Google on the grounds of violating the guidelines of RBI related to data localization, storage and sharing.

In response, Google India Digital Services Pvt. Ltd., the Indian digital arm of the internet giant, told the Delhi High Court that it has every right to share their customers’ transaction data given they have the permission from NPCI and the banks providing the payment service aka PSP.

Google submitted this statement in the form of an affidavit which they filed before a bench comprising of Chief Justice D N Patel and Justice Prateek.

On Thursday, the High Court made its decision to list the matter for hearing on November 10th as both the Centre and RBI aka Reserve Bank of India haven’t filed their responses yet.

GPay Adheres To All UPI Guidelines: Google

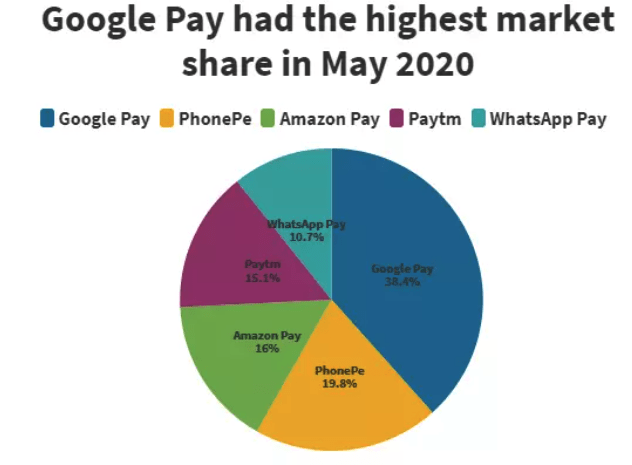

In the affidavit, Google made it very clear that Google Pay, the leading payment app in India with 38.4% share, is not violating any rules that have been set in stone by the National Payments Corporation of India (NPCI).

After a hue and cry against Google’s disclosed, the company released a statement on Friday stating that users need not to worry about anything.

The tech giant said that Google Pay only stores all of the usual customer data such as name, address, email ID and transaction-related details. It doesn’t keep any records of sensitive data such as debit/credit card numbers or the UPI pins as those are stored with the PSP bank via which customers claim.

Google filing the affidavit comes in response to the advocate Abhishek Sharma’s petition who wanted the tech behemoth to not share any data with third-party sources.

The Alphabet-owned giant stood its grounds and contended the petition by mentioning it has always been complying with the NPCI procedural guidelines which oversee the functioning of TPAPs aka third-party application providers such as GPay.

Furthermore, it was mentioned by Google that the petition by Sharma was not necessary as there existed many other alternative ways to approach the problem. He could’ve opted for using GPay’s in-app customer care feature, approaching the NPCI or merely calling on RBI to exercise its jurisdiction.

Google also hinted at the fact that the petition was filed quite exclusively against them as there exist other TPAPs such as GPay, but they weren’t targeting with the same.

Sharma’s petition also claimed that the company regularly accessed their customers’ location data to serve them highly targeted or personalized advertising and mint more revenue.

Of course, Google stepped in to refute this claim as well. It said that Google Pay, under no circumstances, has ever accessed their customer’s geolocation to serve them ads.

The app accesses the location data of a user at the time he or she is making a payment. It does so because Google needs to authorize and authenticate that the payment will be getting processed at a participating store which is nearby.

What new accusations will pop up on the November 10th hearing and how will Google respond back is anybody’s guess right now. We will keep you updated on all the developments. Until then, stay tuned.