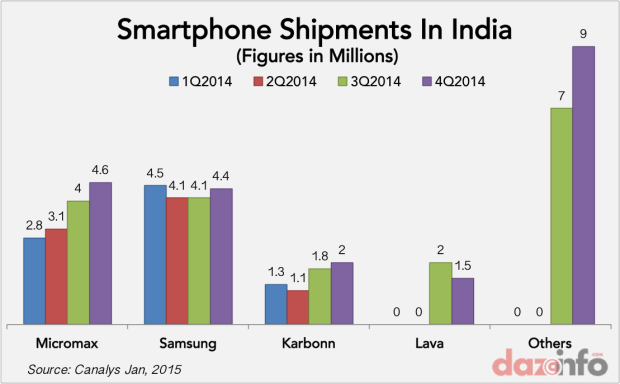

The smartphone market in India Q4 2014 witnessed quite a change in buyers’ behaviour, and that resulted in Micromax leapfrogging global electronics giant Samsung Electronics Co, Ltd (KRX:005935) to take the lead position in the market. This is the first time ever when any homegrown vendor has remarkably registered a phenomenal growth in the smartphone market in India beating all global smartphone vendors including Samsung and LG. According to the latest report from Canalys, 21.6 million smartphone devices were shipped in India during Q4, 2014, making the total smartphone shipments tally reaching nearly 185 million till the end of 2014.

Micromax and Samsung, together, captured 44% of total smartphone shipments market in Q4 2014 while the other competitors Karbonn and Lava were restricted to single digit share during the same period. Micromax shipped 4.75 million smartphones during the quarter, closely followed by Samsung with 4.32 million shipments figure.

The quarter also witnessed changing buying habits of smartphone users; unlike previous quarters when sub-$200 smartphones used to capture more than 70% of total smartphone shipments, the market share of entry-level and mid-range smartphones has abated to 64% in the last quarter of 2014. The report claims that buyers are more inclined towards $100 – $200 price segment, 41% of smartphone shipped during Q4 2014, belongs to the said category, while only 23% of smartphone shipped were price tagged below $100.

Canalys Analyst Rushabh Doshi said, ‘Canalys believes catering to local market preferences will become increasingly important. Micromax has been quicker than its competitors to improve the appeal of devices, for example, by including a wide variety of local languages on its Unite phones. But vital to success is selling these handsets at low price points to appeal to the bulging mid-level income market in India.”

These figures clearly indicate that first-time smartphone users are actively pursuing more apps and mobile internet and wanting to upgrade to mid-range smartphones instead of jumping directly to above $200 price segment. As most of the local and Chinese companies are fueling the competition by introducing smartphones, ranged between $100 and $250, smartphone users are shying away from reaching their pockets for smartphones priced $300 or above. Smartphone devices, likes of Xiaomi Redmi Note, Micromax Canvas Nitro and Canvas Hue, are able to meet the expectations of most of the smartphone users.

Chinese companies, especially Xiaomi, have been able to live up to the expectations with its devices in India. Consequently, the market share of other smartphone vendors in India swelled to a sizable 40.6% in Q4, 2014, up 30% as compared to the previous quarter. Xiaomi has wisely placed its bet to lure almost all the major smartphone segments. Redmi 1S is trying to capture a sizable chunk of the entry-level smartphone market pie, Redmi Note 4G and Mi3 are creating enough of traction in the market in $100 – $250 segment. Recently, the company has launched its much-awaited flagship device Mi4 in India and trying to eat into $250 – $350 price segment, largely captured by Samsung. In the last six month, company has sold more than 1 million devices in India despite demand-supply challenge and ban imposed on one of its devices Redmi Note 3G version. On the other hand, Micromax is also trying to capture mid-price segment by introducing Yureka with a lucrative price tag of $150.

Most of the analysts believe that in a price sensitive country like India, $350 price segment is a new $650 segment. And, as the market would see more powerful big screen smartphone with excellent built quality, smartphone users will keep juggling between smartphones fall under $350 category only.

In Q4, 2014, the smartphone market in India registered a strong 90% year-over-year growth. During 2014, total smartphone shipments figure reached to 47.1 million, up by nearly 30% as comapred to 36.4 million smartphone shipments in 2013.