Honasa Consumer Ltd, the parent of Mamaearth and 5 others, has unveiled its financial results for the second quarter of fiscal 2024, ending on September 30, 2023. Interestingly, the company reported an impressive 21% YoY growth in its operating revenue, amounting to Rs 496 crore during Q2 FY24.

In the fiercely competitive arena of the fast-moving consumer goods (FMCG) sector, Honasa Consumer has emerged as a formidable player. Its 21% YoY revenue growth in Q2 FY24 is impressively 3.2x higher than the median growth of 7% recorded by its FMCG counterparts during the same period. These renowned FMCG companies include Hindustan Unilever Limited, Colgate Palmolive (India) Limited, Procter & Gamble Hygiene and Health Care Limited, Dabur India Limited, Marico Limited, Godrej Consumer Products Limited, Emami Limited, Bajaj Consumer Care Limited and Gillette India Limited.

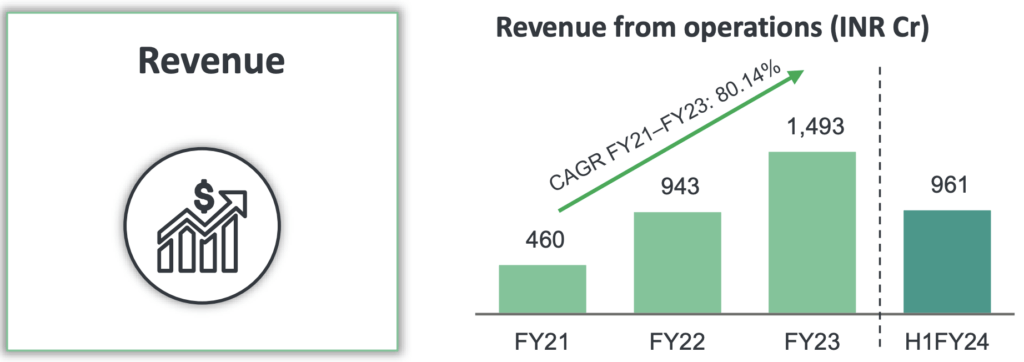

Looking at the broader picture of the first half of FY24, Honasa Consumer maintained its remarkable performance, achieving 33% YoY growth in operating revenue, amounting to Rs 961 crore.

Honasa Consumer Expenses Q2 FY24

- Honasa Consumer’s employee benefit expenses declined 5.1% YoY in Q2 FY24 to Rs 37 crore. The company allocated 7.5% of its total revenue to cover these expenses. This reduction aligns with a broader trend, as many companies are adopting similar measures to enhance profitability.

- Honasa Consumer spent approximately 35.1% of its revenue on advertising activities during the September quarter. The company’s advertising expenses increased 21.7% YoY to Rs 174 crore during the quarter. This substantial investment in advertising underscores Honasa Consumer’s commitment to promoting its brand and products, potentially contributing to increased market visibility and growth opportunities.

- Honasa Consumer’s other expenses rose 25.3% YoY in fiscal Q2 2024 to Rs 94 crore.

EBITDA and PAT Surge

During the September quarter of fiscal 2024, Mamaearth’s parent managed to keep its expenses in check, leading to a remarkable surge in both net profit and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). In the second quarter, Honasa Consumer achieved an EBITDA of Rs 40 crore, with a strong 53% YoY growth. The Profit After Tax (PAT) also surged a whopping 94% YoY to Rs 29 crore during the quarter.

Zooming out to the broader context of H1 FY24, the numbers become even more remarkable. Honasa Consumer reported a staggering 400% YoY growth in EBITDA, reaching Rs 70 crore. The PAT during the same period is nothing short of extraordinary, hitting Rs 54 crore with an astounding 1,377% YoY growth. The significant growth in EBITDA is attributed to Honasa Consumer’s effective leverage in its advertisement and other operational expenditures.

Honasa Consumer has successfully positioned itself as India’s largest digital-first Beauty and Personal Care (BPC) company, boasting a distinctive portfolio of six brands, including the well-known Mamaearth, Derma, Aqualogica, BBlunt, Dr Sheth’s, and Ayuga.