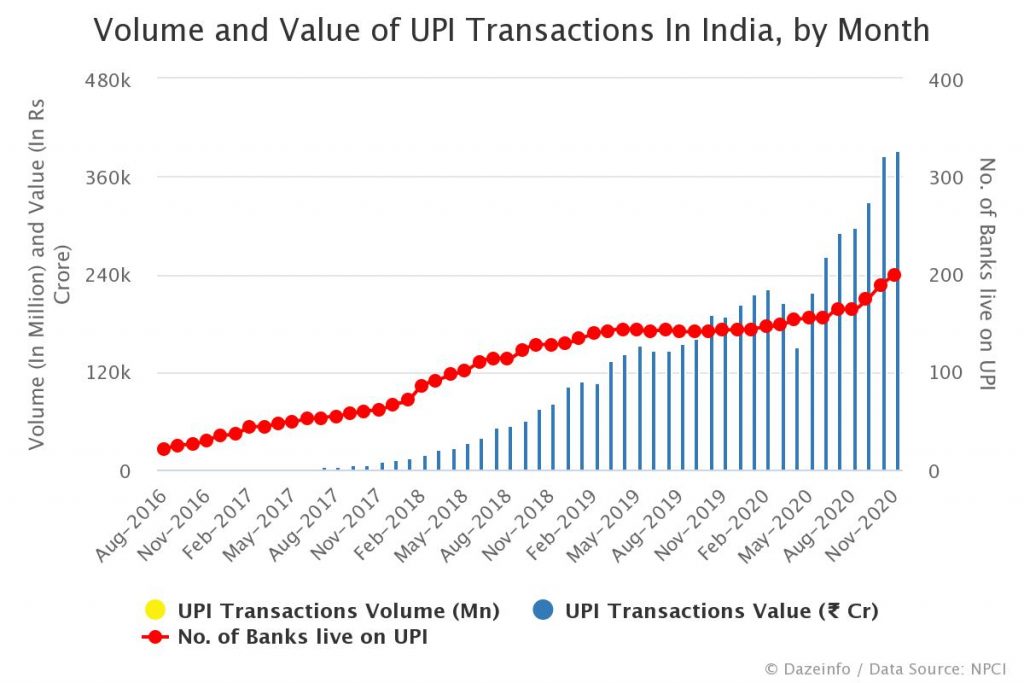

The number of UPI transactions has crossed 2 billion mark in a second consecutive month. With that, it’s clear that the number of UPI transactions is all set to touch a record high 6.5 billion figure in Q4 2020.

According to the latest data released by National Payment Council of India (NPCI), a total of 2.21 billion UPI transactions were recorded during the month of November, resulting in 6.7% month-over-month growth. The transaction volume amounted to whopping Rs. 3,90,999 crore (US$53 billion) during the same month indicating the increasing popularity of UPI among the smartphone users as well as merchants.

In the previous month a total of 2.07 billion UPI transactions, amounting to Rs 3,86,106 crore, were recorded, which made October as the first month when monthly UPI transactions crossed 2 billion for the very first time.

The increasing number of UPI transactions, and considering the holiday season ahead, it’s safe to assume that NPCI is all set to close the quarter with a record number of transactions in a quarter.

Over 4.27 billion UPI transactions have already taken place in the first 60 days of ongoing Q4 2020. In the next 30 days, factoring that people make a lot more transactions during the holiday season, another 2.3 billion UPI transactions will easily be added in December, taking the total tally to estimated 6.5 billion.

December has always been the best performing month for UPI transactions. There were 1.3 billion transactions recorded in 2019 – the highest among all the 12 months of 2019. The trend was no different in 2018 as well when 629 million UPI transactions took place in December of that year – the highest in that year.

Encouraged by the overwhelming response received from the users in India, NPCI is now considering to take UPI payment technology to other countries. Quite recently, NPCI has launched National International Payment Limited (NIPL) and soon the company may launch UPI payment in emerging markets such as Middle East and Africa, which has showwn a keen interetest in adopting the digital payment system.

Launched in 2016, UPI has seen a quick rise to fame as the preferred mode of transaction among Indians. Due to the ease of use and real-time settlement it took no time for UPI to become the preferred mode of transaction for small sums.

Started with just 21 banks, there are now over 200 banks which are live on UPI.