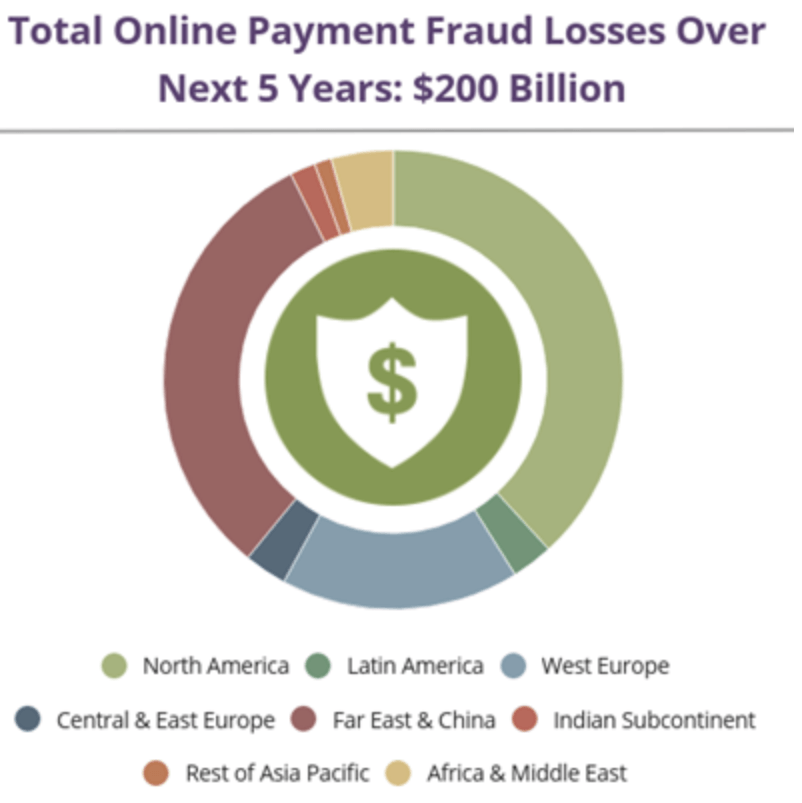

The online payment frauds are becoming a new nightmare for digital users and authorities as well. It has been estimated that a whopping $200 billion will be lost globally by businesses whose primary domain happen to be e-commerce, airline ticketing, money transfer and banking services between 2020 and 2024 via online payment fraud attempts by a new study conducted by Juniper Research.

The increased sophistication of the fraud attempts and the rising number of attack vendors are being considered to be the primary drivers of the losses.

The Juniper Research clearly highlights the fact that the growing global digital payments industry will be one of the biggest hotspots for fraudulent activities with losses growing by 130% from 2020 to 2024.

The chances of fraudsters leveraging these digital payments platforms are supposedly more in emerging markets (such as India) wherein the payments are vulnerable to SIM swapping fraud and synthetic identities, with less robust security measures in place. An airtight KYC (Know Your Customer) verification along with events-based re-verification following onboarding are some of the recommended measures according to the report for securing the rising level of transactions. It has also been said that the implementation of various machine learning analytics might help to identify fraudulent behavioural patterns.

In the Indian market specifically, frauds and scams related to online real-time payment is a major concern. In order to curb this, Paytm which is one of India’s leading online payments platform Paytm has recently filed cases against 3,500 mobile numbers which have been reported as the origin of phishing attacks in order to curb future fraudulent attempts.

It is being believed by the majority of the banks that frauds related to real-time platforms will rise. According to another recent study conducted in Silicon Valley by FICO which is an analytics firm, 78 per cent of the banks in APAC has seen an increase in fraud-related losses. Further to this, almost a quarter (22 per cent) say that fraud will rise significantly in the next 12 months, with an additional 58 per cent saying they expect a moderate rise in fraud.

It has also been observed that in the Asia Pacific region, around 84% of banks have a multifactor authentication and also use a wide range of authentication methods which include biometrics at 64%, normal passwords at 62% and behavioural authentications at 38%.

What seems to be surprising is the fact that around 46%, which translates into nearly half of the banks. are currently using only one or two of these security measures. This leaves a lot of room for attacks such as identity theft, account takeovers and cyberattacks. However, it doesn’t mean that the banking sector is not taking any measures to fight such fraudulent activities. In India, the Reserve Bank of India (RBI), on January 15th, notified all the banks under them to enhance the security features of their debit and credit card transactions.

Interestingly a global pay tech firm from India, Financial Software and Systems (FSS), have reportedly already developed a white-labelled mobile app known as FSS Toggle that will enable the cardholder to control the usage of their cards.

Online Payment Frauds: The Future Weapons To Fight

The Juniper Research believes that machine learning and artificial intelligence have become crucial tools in fraud detection and prevention methodology, as it enables the unlocking hidden insights on fraudulent behaviours. Therefore, payments industry stakeholders can analyse transaction flows in a holistic way. The incorporation of artificial intelligence and machine learning into fraud detection and prevention software will drive spending forward, reaching $10 billion in 2024, a 15% increase in 2020.

President of FICO in the Asia Pacific, Dan McConaghy, however, shares a bit different ideology.

He believes that through the rapid adoption of A.I and machine learning can help create systems that are radically quicker to recognize fraudulent transactions, It won’t slow down the clock. To keep up with the dynamic payments landscape, he believes that banks will need to move beyond passwords and OTPs and add biometrics, device telemetry and customer behaviour analytics.