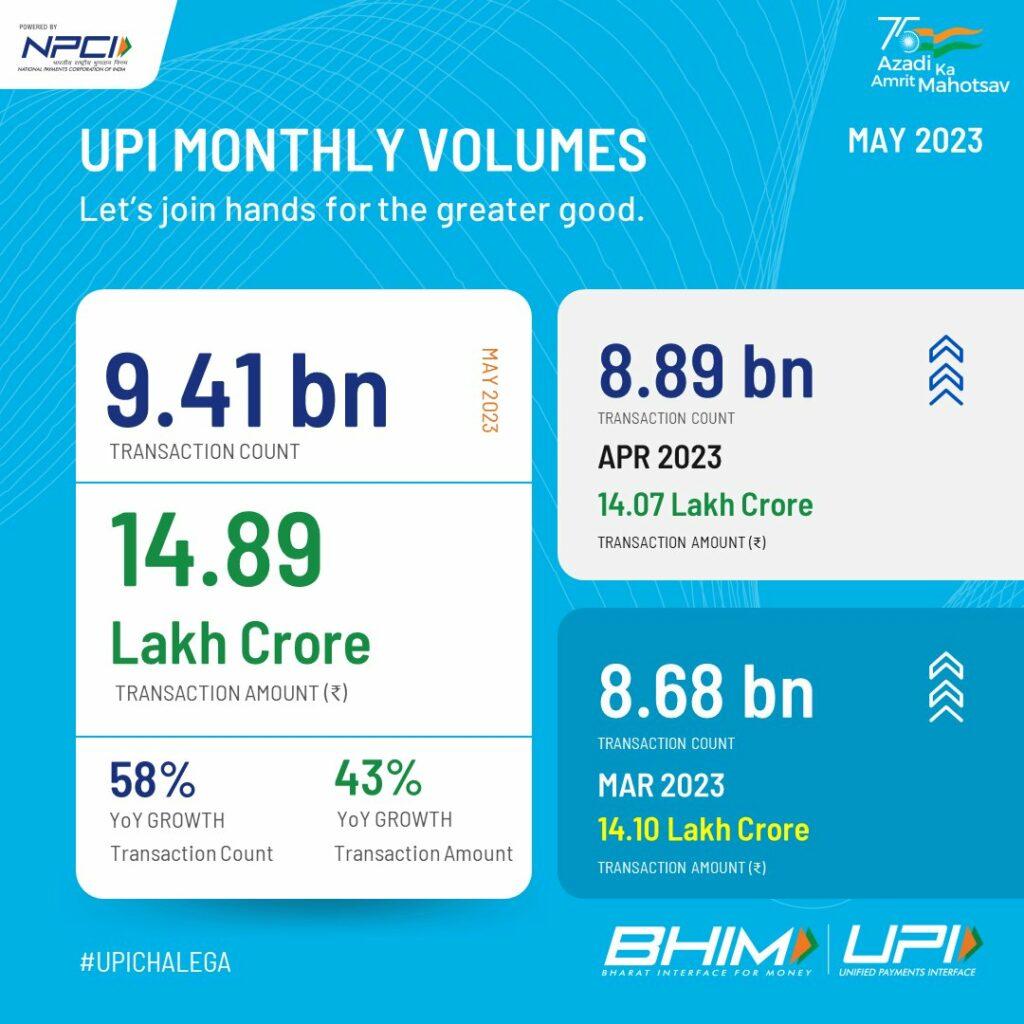

India has seen a digital boom in the last five years, especially after Covid-19 Pandemic. The number of people going online, shopping, and making online payments through UPI, Wallets, or their credit/debit cards has surged dramatically in recent years. According to the latest data by NPCI, the number of UPI transactions surpassed 9.4 billion for the first time in May 2023, up a strong 58% YoY. At the same time, the value of these UPI transactions increased an impressive 43% YoY to ₹14.89 trillion.

When compared to the previous month, India’s UPI transactions volume and value both increased 5.8% and 5.8%, respectively, in the month of May 2023.

This remarkable growth signifies a continued upward trend in the adoption of digital payments, showcasing the country’s increasing reliance on convenient and secure online transactions.

Growth In UPI Transactions In India: Milestone

The year 2022 proved to be a groundbreaking period for the widespread adoption and usage of UPI payment apps in India. In a remarkable feat, the number of UPI transactions crossed the milestone of 5 billion in March 2022, marking an unprecedented achievement. The country experienced an impressive double-digit growth of 19.4% month-on-month and a whopping 97.9% year-over-year, showcasing the rising popularity and reliance on UPI as a preferred payment method.

India set another record in May 2022 by completing transactions worth ₹10.42 trillion through the Unified Payments Interface. This remarkable achievement represented a significant growth of 5.9% month-on-month and 112.3% year-over-year, reinforcing the nation’s sustained enthusiasm for digital payments. The consistent growth in both volume and value of transactions further highlights the increasing trust and convenience offered by UPI, solidifying its position as a transformative force in India’s payment ecosystem.

Other noteworthy highlights

Apart from UPI, May 2023 also marked a remarkable milestone in India’s financial landscape, as revealed by NPCI.

- The number of IMPS (Immediate Payment Service) transactions hit an all-time high of 500 million in May 2023, with a 3% YoY and 0.85% MoM growth. The total value of these IMPS transactions amounted to ₹5.28 trillion, showing a growth of 17% YoY and 0.96% MoM during the same month.

- India also witnessed a notable decline in the adoption and usage patterns of Aadhaar-based transactions last month. Aadhaar-based interoperable transactions volume declined 9% YoY, while value declined 8% YoY. A total of 99.6 million transactions were carried out through the AePS platform in May 2023 with a cumulative value of ₹280 billion.

PhonePe (owned by Walmart), Google Pay, and Paytm continue to maintain their stronghold in India’s UPI payments landscape, with more than 92% market share.

India is going thorugh a digital revolution and record GDP growth is atestament of the fact. The country has witnessed an extraordinary surge in the adoption of digital payment methods, with UPI (Unified Payments Interface) and IMPS (Immediate Payment Service) leading the charge. Month after month, we have witnessed an unprecedented growth in both the value and volume of transactions through these payment methods. This remarkable trend is a testament to the increasing trust people are placing in digital transactions and the convenience they offer. As more individuals and businesses embrace the seamless experience provided by UPI and IMPS, it is evident that India is rapidly moving towards becoming a largest cashless economy in the world. With this exponential growth and the unwavering trust of the people, it is safe to say that digital payments have firmly established themselves as an integral part of the Indian economy, shaping a future that is efficient, secure, and digitally connected.