UPI or the Unified Payments Interface has become one of the fastest-growing payment platforms in India and has draw attention of global policy-makers as well. It is now regarded as an important institutional and public policy innovation.

On Thursday, revelations from a new report suggested that in terms of volume, UPI happens to be the most preferred mode of payment followed by debit cards, IMPS (Immediate Payment Services) and credit cards.

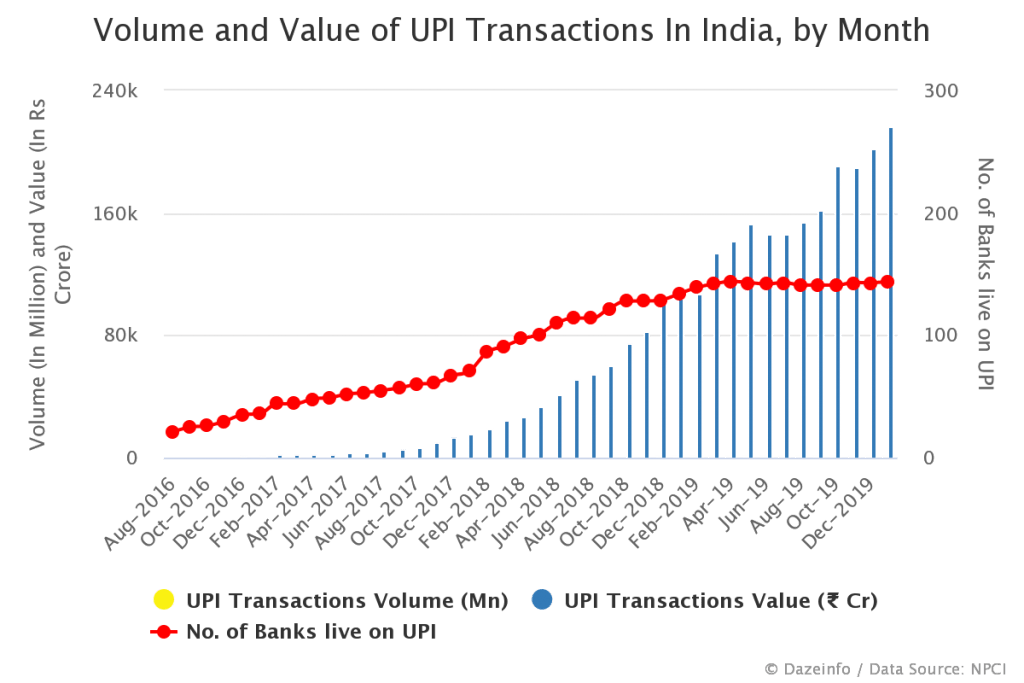

The Indian Digital Payments report by the payments company Worldline India (WI) further went on and reported that in 2019 UPI recorded a transactional volume of 10.8 billion with a 188% Y.o.Y increase. It was also added that UPI happened to be the fastest product to reach one billion transactions in a singular month in 2019 since it launched in the month of August in 2016.

UPI happened to facilitate transactions worth ₹18.36 trillion in terms of vale with a 214% increase in 2019 when compared with the previous year. As of December 2019, the total number of banks providing UPI services stands at 143 as 9 more banks were added in the UPI ecosystem in 2019 itself.

It is P2P (person-to-person) transactions for which major digital transactions platforms are being mostly utilised for rather than P2M (person-to-merchant) transactions.

When it comes to Immediate Payment Service (IMPS) a whopping 2.3 billion transactions in volume were facilitated, a record 55% YoY increase. In terms of value, IMPS also happened to record ₹21.8 trillion since 2019. Over 165 banks came on board under the IMPS ecosystem in 2019 which brought the total number of banks providing the payment service up to 559 by the end of the previous year.

IMPS still happened to remain in the first position throughout 2019 followed immediately by UPI in terms of value. The report also suggested that the value of debit and credit cards remained the same through 2019. Combined transactions recorded together by UPI, debit cards, IMPS and credit cards of over 20 trillion in volume and of over ₹54 trillion in value was observed in 2019.

Over the past few years, a full range of Aadhaar enabled banking services through AePS was observed in India. A volume of 2.3 billion Aadhaar Enabled Payment System (AePS) transactions (ONUS, OFFUS, DEMO AUTH and eKYC) were recorded in 2019 which shows a 12 Y.oY growth. The value of AePS transactions stands at ₹1 trillion as of 2019, a 31% YoY growth.

Worldline India accessed public databases for transactions to conduct their research together with the transactions processed by them in the year 2019.

Way Forward For UPI In 2020

As of January 2020, 1305.02 million UPI transactions amounting to ₹2,16,212.92 crores were processed by 144 banks. Coming to card transactions, a whopping 4,137.41 million transactions were completed through either debit or credit cards in India during fiscal Q2 2019-20.

The above growth chart of UPI transactions clearly indicates that UPI could rapidly become a preferred payment option for merchants, with its relatively cheap infrastructure requirements, and widespread consumer adoption. However, a sustainable boom in digital payments requires an equal focus on the entire value chain from banks to digital payments service providers, merchants, and most importantly the consumers.

UPI’s growth spurt has majorly been driven by its ease of use, owing to a combination of consumer-facing digital payments platforms and an active push by the Indian government. Google Pay, PhonePe, Paytm emerged as the real game-changers for peer-to-peer (P2P) UPI payments, which would further be fueled as WhatsApp, currently in beta stage, joins the race.

As SMEs start to understand the benefits of digital payment acceptance the peer-to-merchant (P2M) channel has also started gaining momentum. With the launch of UPI 2.0 last year, the platform is attracting a healthy share of merchants and helping with the digitisation of the entire payments ecosystem by enabling low-value, high-frequency transactions.