India is one of the fastest growing economies worldwide, and acceptance of Digital Payments in India has been one of the major reasons behind this phenomenal growth. As all eyes are set on India; the government is leaving no stone unturned to transform the country into a complete digital economy. Industry experts believe that India, along with China, will be the powerhouse of future growth of digital payment worldwide.

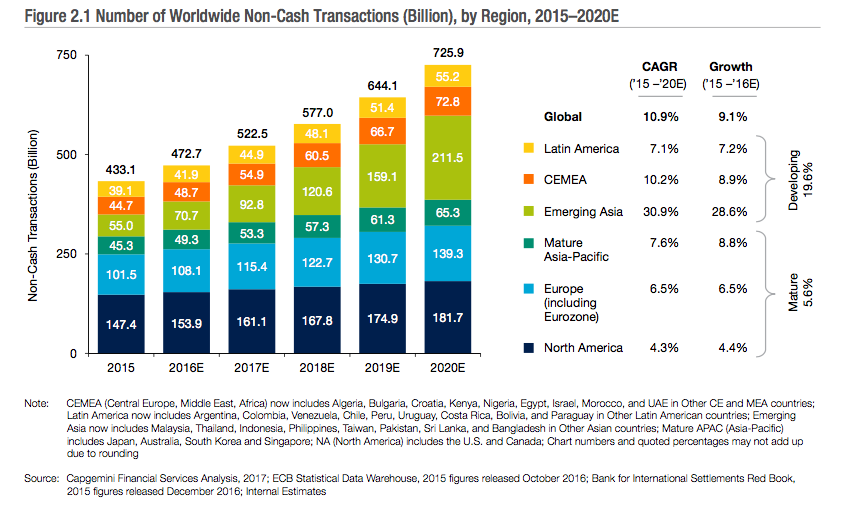

According to the latest World Payment Report 2017, by Capgemini and BNP Paribas, digital transactions in India is estimated to grow at 26.2% CAGR between 2016 and 2020. Though India is expected to lag behind China, which is expected to clock 36% CAGR in digital payments during the same period, considering the large untapped population of non-smartphone users, the digital payment scenario in India looks equally promising for the next one decade.

The recent initiatives of the Indian Government and National Payment Council of India (NPCI) will further boost the confidence of homegrown and foreign companies operating in the space of digital payments. The 25 billion digital transactions target set by the government for 2017 – 2018 will also push the growth in the coming years. The figure is expected to comprise 11 billion debit/credit card transactions, 6 billion mobile transfers and 8 billion online transfers.

Mobile To Drive the Growth of Digital Payments In India

To figure out the driving forces behind the expected growth of digital payments in India, we need to look back at the growth of Digital Payment in China for the year 2015, 2016.

With nearly 700 million active smartphone users in China, the smartphone industry has started heading towards saturation. Interestingly, 95% of the internet users in China access Internet from their mobile phone. For the last few years, China has been transitioning directly from cash to mobile payments. The humongous smartphone user base in China helped the mobile digital payment industry to register an impressive 85% growth in 2016. In the next two years, the industry is expected to grow by 68%. It is also estimated that more than 50% of smartphone users in China will be using mobile payments by 2020.

Both merchants and users, in China, find it convenient to store their payment history on their smartphone. It allows them to have the critical financial information available at the tip of their fingers. Besides, Chinese users are also found open to experimenting with new forms of digital payments, which is a positive sign for the digital payment industry of China.

In India, only one-third of mobile phone users have smartphones, albeit the penetration (population) of a mobile phone has already crossed 80%. With just 450 million smartphone users, India is entering into a smartphone revolution era. It is estimated that the smartphone users base in India will swell to 702 million by 2020. The smartphone users in India are now spending more time on the Internet than ever before. According to a recent study, 40% of smartphone users in India spend 2-6 hours of their daily time on the Internet. With the growing dependency on the Internet, this time is bound to increase in the future.

The low penetration of smartphone and internet portray a big window of opportunity for all digital payment players in India. Aggressive marketing strategies employed by Digital wallet companies, the instant online money transfer facility by banks and demonetisation drive by the government have encouraged smartphone users to rely on mobile payment as much as possible.