India, now the second largest smartphone consumer market in the world, has recently been at the centre of attention of many smartphone OEMs. In fact, Apple CEO, Tim Cook, has been quite vocal in his thoughts that Apple would look to get out of the slump that they’re in, by targeting rapid growth in India. However, for India to have any chance of becoming the next growth facilitator for Apple, the price of iPhones has to come down dramatically as the ASP of Indian smartphones is under $160. Apple’s genius move was to reduce pricing costs in India by selling refurbished phones to the Indian consumer, a plan that was shot down by the Indian government.

With Apple’s market share in India hovering at a measly 2%, this new decision is sure to be a major setback for the company who are trying hard to reverse their fortunes and get their iPhones sales figures back on track. While a similar plea had been rejected before by the government in 2015, citing environmental reasons, this time, there was more to this refusal than just a bureaucratic decision. Lobbying hard against Apple and the refurbished iPhones was the Mobile and Communications Council of India. Incidentally, this newly formed council is headed by some of the most popular handset manufacturers in the nation with the likes of Samsung and Micromax making up the ranks! So is there more to this than meets the eye? We investigate!

The Refurbished Market In India: Apple’s Golden Opportunity

In Q4 2015, the warning bells were already ringing for Apple. As they took to the stage to discuss Fiscal Q1 2016 results with the world, Apple had some ominous news for the shareholders and investors alike. Despite having posted the most profitable quarter ever, the writing was on the wall. The newly released iPhone 6s and 6s Plus had not been able to garner much attention and a vast majority of people were sticking to their older devices as upgrading to the new iPhone didn’t make much sense.

Apple foresaw that the global smartphone market was going to hit a slump in Q1 2016, and with the world’s largest markets like the US and China, both showing signs of slowing down, the Cupertino giant needed a miracle from their CEO. Tim Cook tried to pull a Steve Jobs by launching two programs that were dedicated towards the Indian market, the only place where smartphones were still growing at a prolific rate. The first was a budget oriented iPhone, the 4-inch iPhone SE; and the second was the scheme for releasing refurbished iPhones in India’s budget smartphone market.

Now while both of these two plans fizzled out, today we will focus on the latter, as this time, Apple may have been the victim of conspiracy rather than their own pricing strategy which has so often been the case before. Apple had previously suggested that Apple should be allowed to sell their refurbished iPhones, which are basically old units that have been traded back or have been unboxed and returned and then restored and given a new IMEI by Apple technicians. Doing this would allow Apple to lower the cost of their end products in India while Indian fans would be able to enjoy the Apple experience at a bargain price. For this end, Apple also suggested that they are allowed to open retail stores in the country where Apple fans can come and experience their products first hand.

And, although the opening of retail stores in India went off without a hitch, and Apple managed to even get by the Government norms for the 30% sourcing policy, they were not so lucky with their initial request. Citing reasons of e-waste and environmental hazards, the government and the consortium of rival Android manufacturers managed to shut down Apple’s request for refurbished iPhones for good. Their main reasoning hinged on two critical points:

- Violating the Made in India Rule: Under the tenure of Prime Minister, Narendra Modi, the ‘Made In India’ initiative has been put into motion for all electronic manufacturers which encourages them to produce or assemble at least some or all of their products meant for India, on Indian soil. Apple’s refurbishing plans did not include any such refurbishing plants in India and hence, was met by strong opposition by their competitors. Samsung, the current leader among smartphone OEMs in the Made in India campaign and Micromax, the homegrown company were the two most vocal protestors. Incidentally, they’re the top two smartphone OEMs in India in terms of market share at the moment.

- Increasing Electronic Waste And Endangering the Environment: A new report by Apple has pegged their smartphone life cycles at 3 years before they become a hazard to the environment. Even though latest reports say that a refurbished iPhone will have the same lifespan as a regular iPhone we are reluctant to believe this as is often the case with refurbished units, only the problematic parts of the smartphone are repaired or replaced leaving the rest entirely untouched. This is one of the primary reasons that refurbished phones cost as less as they do. This in essence by the time a refurbished iPhone has come to the end of its 3-year second life in the hands of an Indian consumer, a majority of parts inside the phone have aged around 5years and can only be dumped into e-waste.

So did Apple really intend to turn India into it’s dumping ground? While the words of their competitors might make it seems that they did, common sense tells that a company as environmentally conscious as Apple would probably not take such a reckless step. However, the fact remains that Apple has been shut out of the business, and while the judgement meted out was fair or unfair remains unclear, their competitors are rejoicing and so are a group of lesser known but rapidly growing segment of e-commerce players. Who are they and what is the cause of their mirth? WE discuss in our ending statement.

Final Words

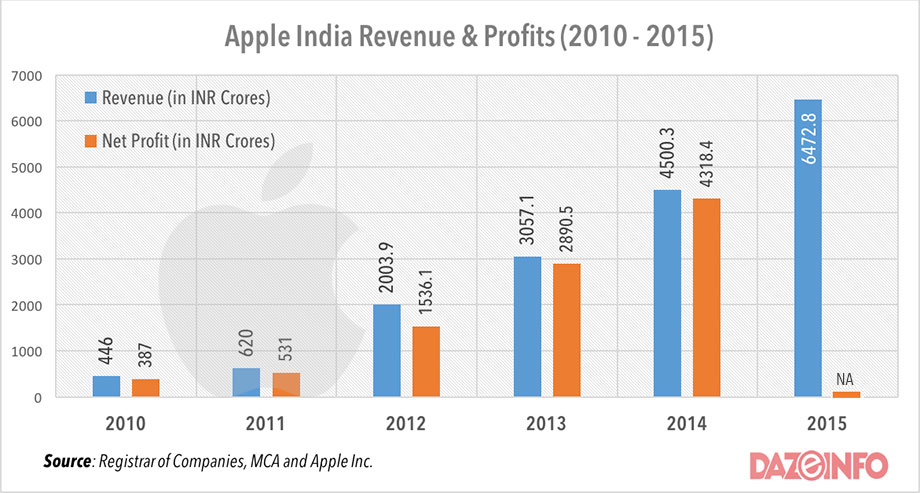

In the last few quarters, Apple has done quite well in India amassing over $1 billion in cumulative sales. However, there is a twist to the tale as looking deeper into the numbers would reveal that a huge chunk of the revenue has come from older devices like the iPhone 4S which fell under the $160 ASP mark during Q3 2015. But Apple in typical Apple fashion wanted to get a yard from an inch and as a result early in 2016 exited the under 20k price category pulling the 4s and 5C models from India. Apple might have looked to re-enter the space, possibly with refurbished iPhones but their competitors sensing the opportunity has once again been able to cut Apple off entirely from the rapidly expanding budget segment of the Indian market.

While the OEMs have been busy in trying to oust Apple from the sub 20k INR segment, a few smaller startups like the refurbishing company Greendust has been reaping the rewards. Taking advantage of the popularity of the Apple brand name and the price constraints of the Indian market, Greendust released a refurbished version of the iPhone 4s under 10K INR. Small enough to escape unnoticed by the larger OEMs, the refurbished market has been steadily growing in India and as e-commerce takes over more of the Indian smartphone market, these refurbishing companies will exhibit a growth spurt as well.

While not much data is available readily as most of the refurbishing industry in India is still limited to small scale companies, yet Gartner predicts the total market to be at around $3 Billion by 2017. Despite that, many e-commerce players have been quick to realise the potential of the refurbished markets and players like Amazon India and eBay.in have jumped into the fray. Some newer startups like Overcart have gone one step further and along with the refurbished phones, which they claim have been done by the OEMs themselves, also provide 6-month manufacturer warranty.

With the governments across the globe pushing for more nad more refurbished IT materials, we are sure to find the Indian government revisiting this decision of theirs and wondering if they had made a mistake! Afterall refurbishing is around 25 times more environmentally friendly than dumping old electronics and hopefully, once the refurbishing smartphone industry is big enough to capture the attention of the other OEMs as well, India will see their own domestic products being refurbished and sold instead of playing host to old products from across the ocean.

Hitendra Chaturvedi, Founder & CEO, GreenDust Pvt Ltd says,”Studies indicate that by 2020, e-commerce in India will be $115 billion and assuming 10%-15% return rate means that over $12-$17 billion in value of products will be returned every year.”

What remains to be seen is how e-commerce giants, refurbishing companies and OEMs themselves manage to divide this $17 billion industry among themselves in the next half a decade. For now, Tim Cook will be left with a defeated smile, as Apple’s dream of making India the next China seems to be falling apart even before it has begun. The most tragic part of this entire scenario. Apple products, especially the iPhones are the smartphones that are in most demand in the refurbished Indian market, yet the Cupertino giant can only watch while Indian startups reap the profits of the Apple logo!

[poll id=”52″]