The global mobile industry is undergoing many changes with smartphone adoption rates increasing, new players emerging and revolutionary pricing strategy. In tune with the global mobile industry, India is also witnessing a radical change in the handset arena. It has become a hot target for the mobile makers all over the world. The most popular reason being the untapped potential in the country which promises immense growth in the future.

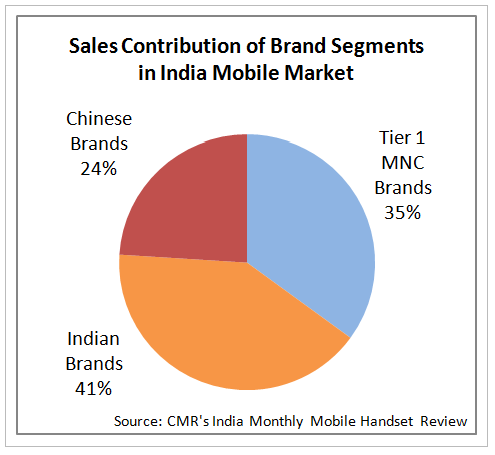

As per the reports from CMR, the Chinese brands and OEM’s, particularly Xiaomi, have taken the mobile industry in India by storm with a cumulative smartphone shipments of 24%. The homegrown brands lead the market with 41% contribution in smartphone sales and MNC Tier 1 brands like Apple, Nokia (Microsoft), Sony, LG, HTC, Blackberry etc comprised of 35% of the sales.

The emergence of Chinese brands and OEM’s like Lenovo, Huawei, ZTE, Gionee, Asus, Xiaomi, Oppo have gained prominence in the recent years in tune with increased smartphone penetration. These brands have surged as a third front in the industry. And same has been the case for numerous homegrown players like Micromax, Lava, Karbonn, Spice, iBall, Intex etc. Nokia, which was once the unrestrained mogul of the Indian mobile handset industry, faced a steep decline with the new homegrown players and Chinese OEM’s surfacing. The other chunk of market occupied by tier 1 MNC brands like Samsung, HTC, LG etc also gained quite prominence in the country as the loyal user base for Nokia started migrating towards more greener pastures. But since 2013 the indigenous players as well Chinese manufacturers and brands have been gnawing at the share of the established outfits like Lenovo, Huawei and MNC Tier 1 brands like Samsung, Nokia, HTC etc.

Though the homegrown brands and Chinese/Taiwanese OEM’s or brands are faring quite well as is indicated by their QoQ growth and the more established players in the market are facing the most heat, it’s hardly a matter of time that these two leagues are battling each other head to head. The Chinese OEM’s have surprised the global market with their sky rocketing sales in foreign waters despite minimal advertisement. Carving a niche for them in such a competitive market when the tier 1 MNC brands are being thwarted by the homegrown brands is a caution for the homegrown brands that they shouldn’t underestimate the rival.

With the average selling price (ASP) of handsets declining the battle is going to be intense among the third front and indigenous players. The time factor in supply chain management is going to play a pivotal role in this battle. And the Indian players will have an added advantage here as they can have more effective distribution and service centers. Apart from this the perception of people towards the Chinese brand can act as a game changer. But relying on only these two tactics isn’t going to suffice. And the Indian makers must focus on improving research and development instead of offering stereotypic devices in the market.

The Digital India and Make in India are two initiatives recently launched by the GOI and the Indian makers must utilize this opportunity to the fullest. The R&D segment can be reinforced under these initiatives to ensure success of both the mobile handset manufacturers and the mission. One more aspect they can focus on is to understand the needs of the society the mobile industry is going to cater. The Digital India initiative aims successful internet inclusion of rural population. To bring the lower rung of the society into the purview apps in native language can play a very important role and the Indian makers can cash in on this opportunity. Since most of the rural population is agro-dependent, the mobile handsets can include some agricultural related apps in them.

Apart from churning out user oriented products and taking the customer service game a notch higher the other factor which is going to be a determiner in this game is going to be the pricing. The popularity of devices from Chinese vendors like Xiaomi is mainly due to the specifications being offered in the devices at the price point. So spending on R&D and manufacturing in homeland instead of outsourcing components will be essential to provide effective pricing.

Another noteworthy strategy being adopted by Chinese vendors is their advertising. Engaging in exclusive tie-ups with some of the greatest e-retailers in the region to sell their devices, they are cutting huge chunk of cost spent on advertising and are diverting it to more pressing issues like R&D.

In the new era of smartphones and internet savvy generation, the Chinese vendors like Xiaomi have already become a nuisance for the mobile giant Samsung in many corners of the world and if the Indian players are not taking timely measures to intervene the situation might turn out the same for them.

But at the end of the day whoever grabs the maximum share of the market, the winner will be customer and the OS giant Android. With Android pushing its Android One initiative with Micromax, Karbonn and Spice in the Indian market the pricing game has taken a new dimension. The Indian market is going to stay abuzz with activity in the future as the three chunks of the mobile handset industry engage in battle against each other.