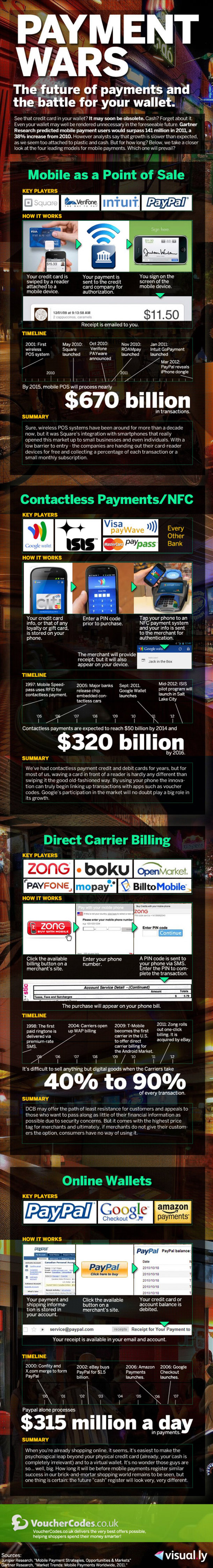

Previously, I have mentioned that users have lack of trust on the mobile payment due to the security vulnerability. Despite these, users are more relying on mobile devices for digital payments worldwide. The reason is quite obvious that it is flawless and easy to use. According to Gartner previous prediction, the mobile payment users would cross over 141 million figure by 2011, up 38% from the prior year, but the growth was slower in the last year than expected.

In 2011, first wireless Point of Sale (POS) system was introduced, but the main revolution began in 2010 when “Square” was launched. In January 2011, Intuit Go Payment was launched, and later, PayPal also introduced its iPhone Dongle in the March of this year. It’s expected that Mobile payment will reach $670 billion by 2015 in the transaction.

Likewise, RFID based “Contactless Payment” was introduced in 1997 and Google Wallet was introduced by the search engine giant in September last year. The transaction of contactless payment is expected to reach $50 billion by 2014 and $320 billion by 2016.

However, the direct billing was introduced in 1998 but T-Mobile was the first carrier in the US offered “direct carrier billing” for Android Market in 2009. Indeed, it’s very difficult to sell digital good (for digital mobile apps and services provider) when carrier will take 40% to 90% for each transaction.

At present, the big giants of online wallets are PayPal, Google Checkout and Amazon payment. In 2000, Confity and X.com merge to form PayPal and later in 2002, eBay acquired PayPal for $1.5 billion. In 2006, Google and Amazon launched its “Google Checkout” and “Amazon Payment” respectively.

Must see the infographic for getting further information related to digital mobile payment:

Source: VoucherCodes