The global smartphone market is growing fast with continuous advancement in technology and digital trends. Even after the recall of Samsung Galaxy Note 7, the worldwide smartphone shipments in Q3 2016 totalled 362.9 million units, registering a 5.7% QoQ growth from 343.3 million units shipped in Q2 2016 and 1% YoY growth from 359.3 million units shipped in Q3 2015. The shipments figure is resulted in $9.4 billion in the global smartphone operating profit in the third quarter of 2016, according to the latest report from Strategy Analysis.

But the biggest surprise is the rise of Chinese Smartphone manufacturer Huawei, which is slowing turning into the biggest threat to Apple Inc. (NASDAQ:AAPL) and Samsung Electronics Co Ltd (KRX:005930) both. The rise of Huawei in the global smartphone market is not pegged only to increasing market share, if analysed, there are multiple factors are favouring Huawei and may help the company to leapfrog Apple and Samsung soon.

To understand why should Samsung and Apple, both, pay close attention to the strengthening market presence of Huawei in Smartphone segment, it’s important to have a look at the few market scenarios.

Huawei: Grabbed the Second Largest Pie of Global Smartphone Profit

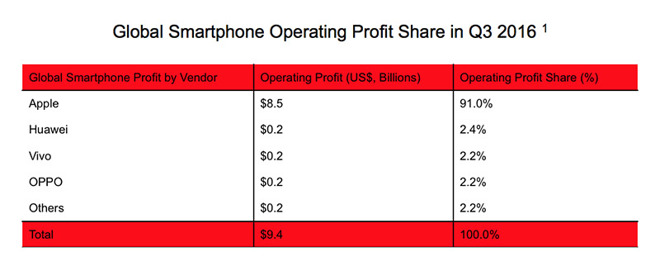

Despite being the second largest Smartphone vendor, Apple captured the largest chunk of the global smartphone operating profit. Apple accounted $8.5 billion (91%), followed by Huawei (2.4%), Vivo (2.2%), Oppo (2.2%) and others (2.2%) with $0.2 billion each.

Interestingly, Samsung is nowhere among the top four names in Q3 2016. In the previous quarter, Samsung accounted for a sizable 31% share of the smartphone industry profits, far ahead from Huawei, Vivo and Oppo. However, the list changes completely if we list down smartphone manufacturers making the maximum operating profit based on OS. In the Android market, Samsung lead the camp with 82% in the smartphone profit share in Q2 2016, followed by Huawei. Clearly, Q3 was the worst quarter for Samsung smartphones.

Clearly, Q3 was the worst quarter for Samsung smartphones.

Note 7 Was a Nightmare for Samsung

The primary reason for the fall in the smartphone profit share of Samsung was the recall of Note 7. The Note 7 debacle was an unfortunate issue that Samsung had to face. Samsung had no other option but to halt the production of the Note 7 devices, which incurred several losses. All the costs like that of production, marketing, distribution went in vain. Even the recall process and investigation to find out the cause for the battery explosions incurred huge costs. Samsung even offered $100 credit bill to its customers who exchanged Note 7 for any other Samsung smartphone. Therefore, swapping 2.5 million units of a flagship device was a huge setback and invited several losses for the company. Moreover, Samsung, in its guidance earnings report posted that they incurred a loss of around $2.3 billion in just two months due to the Galaxy Note 7.

And it’s not just the Note 7 debacle. The sales units of Samsung smartphones started falling since the very first quarter of 2016. In Q1 2016, Samsung has shipped a total of 81.9 million units of smartphones, which has come down to 77 million units in Q2 2016 and further to 72.5 million units in Q3 2016. It seems like even in the fourth quarter Samsung might report a decrease in sales since they have no latest device to bank on other than the Galaxy S7 and S7 Edge. The decline in unit sales in the third quarter can be justified with the Note 7 recall but what about Q1 and Q2?

Huawei Closing the Gap Between Samsung and Apple?

The Chinese OEMs are on the rise with Huawei leading the camp. Huawei has been reporting constant growth since Q3 2015, seemingly closing the gap between Apple and Samsung. While Samsung and Apple are posting the decrease in their sales and market share, Huawei has consistently been growing. In the latest one year, Huawei’s smartphone market share had gone up to 9.3% in Q3 2016 from 7.6% during the same quarter last year. It is clearly visible that Huawei is closing the gap with Apple which accounted 12.5% share of smartphone shipments in Q3 2016. The credit for the growth goes to Huawei’s effective and efficient supply chain and marketing. Even the product line up has been very strong ever since the company started focusing on the premium smartphone segment.

Huawei has been focusing to strengthen its market presence for the last two years. The company’s product lineup has been very strong ever since the company opted the two-brand approach to capturing the market. The strategy to tap into the market with two different brands is apparently paying off well for the company. With ‘Honor‘ brand smartphones Huawei is targeting entry-range and mid-range smartphone users, while it’s penetrating the premium smartphone segment with Huawei brand smartphones. The success of recently introduced Honor 8 and Huawei P9 are the clear example of how the company has started making Apple and Samsung run for its money.

Huawei has already shipped more than 100 million units of smartphones in 2016. Recently, the company has announced that Huawei P9 has surpassed 9 million sales, worldwide, in just six months since its launch. Huawei also develops its hardware from end-to-end, eliminating the dependency on any third party, like Samsung. Also, in terms of profit, Huawei is at the second position after Apple now.

The important factor that gives a big boost to Huawei is in-house manufacturing capacity. Unlike Samsung, Huawei manufactures a majority of smartphone hardware, especially chipset, eliminating the dependency on any third party, like Qualcomm or Mediatek. The Kirin processor that is put under the hood of almost every latest smartphone of Huawei is developed by HiSilicon, a fully owned subsidiary of Huawei.

The decades of experience in mobile networking solutions and mobile data gives Huawei and edge over Apple and Samsung. The company has been providing mobile networking solutions to more than 550 telecom operators and 144 countries. Huawei tops the list of mobile data dongle manufacturers with 55% market share globally.

Huawei Got A Long Road Ahead

All said and done; Huawei has got a long road ahead before it could conquer the global smartphone market. Despite having many technical advantages over Samsung, There are areas where Huawei lags far behind than Apple and Samsung. Among all such areas, brand value and customers loyalty are the biggest challenges. Probably, Samsung could bounce back with a sizable share of operating profit next quarter pushing Huawei down to the third position.

The race between these Apple, Samsung and Huawei is becoming intensifying with each passing quarter. It is, however, tough to predict what the future holds for each one of them. There are few questions which are running in our mind, but only the future can answer. Will Samsung get back on track? Will Huawei succeed in closing the gap between Apple and Samsung? Well, keep an eye on this space for further updates.

There are few questions which are running in our mind, but only the future can answer.

- Will Samsung get back on track?

- Will Apple be able to safeguard its ground with high margin on iPhone?

- Will Huawei succeed in winning customers’ loyalty and emerge as one of the most trusted global smartphone brands in Smartphone segment?

Well, keep an eye on this space for further updates.